This graph shows how Thai banks benefit from a sudden surge in corporate loans

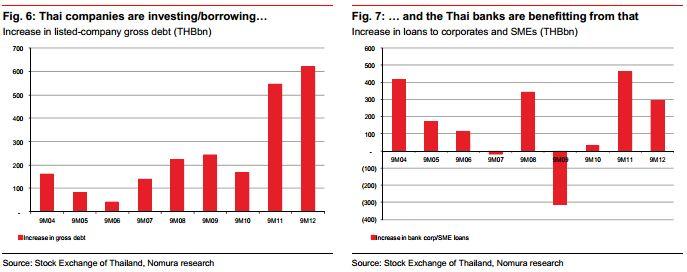

Listed-company gross debt increased by THB621bn in 9M12.

According to Nomura, underlining the increase in investment is the fact that the increase in listedcompany debt in 2012 is the highest post the 1997 financial crisis. Listed-company gross debt increased by THB621bn in 9M12, vs a THB546bn increase in the year-ago period.

Here's more from Nomura:

The resources sector (ie, energy and utilities) accounted for half (THB300bn) of the increase in gross debt, followed by property and construction (THB95bn), agro and food (THB86bn) and industrials (THB82bn). Of the 24 different listed industry segments, 14 saw higher debt/equity ratios from Dec-11 through Sep-12.

The increase in loans by the banking system to the corporate and SME segments does not match the increase in listed-company debt in 9M12, but nonetheless remains significantly above historical levels.

Note that 2008 was an anomaly, given the surge in oil prices which resulted in firms taking out (temporary) working capital facilities to cover this increase. These working capital facilities were subsequently paid back in 2009. The THB297bn increase in loans to corporate/SME in 9M12 compares with an average increase of THB143bn (for the 9M period) from 2003-10.

Note that whilst the corporate debt market in Thailand is growing, it is still relatively underdeveloped which is why most Thai companies still borrow through the banking system.

Excluding financials, corporate bonds outstanding in 3Q12 stood at THB949bn, equivalent to 17% of corporate/SME loans in the banking system. This was up (THB90bn) from 2011 or 16% of corporate/SME loans (13% in 2007).

Advertise

Advertise