Low-code/no-code technology elevates financial processes

Labour-intensive tasks become a thing of the past as citizen developers create custom solutions with Intelligent Automation.

Financial institutions (FIs) continue to try to beat each other by leveraging technology that would enable them to be faster, more efficient, and customer-centric. This is especially true for FIs in the Asia Pacific where some of the best banks and financial services firms are jostling for the top spot.

The sector has been an early adopter of technologies such as Artificial Intelligence (AI), Machine Learning (ML), and Intelligent Automation (IA), which encompasses Robotic Process Automation (RPA), revolutionising the banking and financial industry to a massive scale.

Automation

To employ AI, ML, and IA effectively, FIs would first need to reassess their business and workforce operations and impose strict guidelines to ensure these technologies are employed responsibly to create a frictionless customer and employee experience.

In an era where customer experience is a make-or-break deal, IA lowers the cost of operations by automating heavy loaded and manually intensive tasks. The ability of Machine Learning allows customers to be segregated to better identify their customers’ wants and needs.

According to intelligent automation solutions provider Kofax, firms commonly automate the digitisation of diverse front- and back-office functions within their firms, allowing them to focus on innovative tasks. But these siloed functions often result in high technical debt, delays in successful outcomes, and problems of scale.

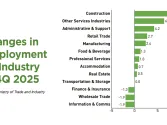

Currently, automation initiatives within companies are outpacing the IT team’s ability to deliver solutions through traditional coding, due in part to the global shortage of developers.

To reduce the reliance on developers, companies are leveraging citizen developers who can learn to use platforms that allow them to build applications without much technical knowledge.

The low-code approach

How does low-code/no-code technology work? This is a method where citizen developers – non-IT employees who create applications for use by their department – use a user-centric platform with technologies including cognitive capture, digital workflows and artificial intelligence to create apps and automated robots using the beauty of drag-and-drop interfaces and custom widgets.

From a development perspective, this approach eliminates the need to build core application modules from scratch which can typically be a costly, labour-intensive and lengthy process. Additionally, it enables financial institutions to be more agile and empowers employees to shape their work, in a way that aligns with their processes using workflow automation to streamline business processes. It also bridges the gap between IT and non-technical business users.

From a utilisation point of view, the benefits to FIs abound. For instance, banks can use the platform to generate and access real-time databases and automate the credit appraisal process to optimise documentation and quality. Integrated with backend systems such as SAP or Oracle, low or no-code methods create the technological infrastructure for customer data management. This also applies to customer onboarding whereby the onboarding app captures the applications and supporting documents, uploads them to the back-end systems. Signature verifications on checks and credit cards are also done automatically.

Compliance and fraud prevention is another key area. It has become a must for FIs to comply with strict Customer Due Diligence (CDD) and Know-Your-Customer (KYC) policies to prevent identify theft, financial fraud and money laundering. FIs can now automate what were once time-consuming and error prone CDD and KYC checks using IA.

Financial institutions leveraging automation solutions cut thousands of hours of manual effort in processing documents and improve employee productivity and efficiency, as well as boosting customer satisfaction and ensuing regulatory compliance.

End-users know best when and how it comes to improving their workflow and are likely to proactively use efficient and productive solutions. Closing the gap between IT and business is essential, and empowering the citizen developer highlights the importance of these emerging solutions based on how the market is moving today. Unlike well-versed developers, citizen developers tend to be less technical, an important aspect to consider. But their unique requirements can lend enhanced capabilities within the automation platform.

Low-code and no-code technology not only solves the lack of IT personnel but also empowers employees to contribute to automating workflows, take over foundational work with their in-depth knowledge of specific business processes and operations, and enable more experienced developers to focus on more high-return digital transformation initiatives.

Businesses would do well to make citizen developers an integral part of their automation and digital transformation strategy, as well as making smart choices in identifying the best tools and platforms that can be easily embraced by employees who have no technical foundation. To ensure that the best tools are selected, it also pays to consult a trusted and knowledgeable vendor who can recommend solutions that best fit the organisation's intelligent automation requirements.

For more information or enquiries on low-code/no-code Intelligent Automation solutions, contact Kofax.

Listen to the podcast below to know more about their project:

Advertise

Advertise