ABF Retail Banking Awards

Inquire Now

Download Awards Deck

Recognising the best of the best in the banking and finance industry

Now in its 21st year, the esteemed Asian Banking & Finance Retail Banking Awards returns as the premier awards programme for the banking and finance industry in Asia. This prestigious event recognises and celebrates outstanding organisations that are transforming the retail banking landscape. Serving as a distinguished platform, the awards programme enables retail banks to showcase their innovative solutions, retail products, digital banking initiatives, and exceptional customer experiences that are setting new industry standards.

The sector continues to evolve rapidly, driven by emerging technologies and increasing competition. Now, more than ever, it is vital to honour and celebrate the retail banking sector’s excellence, innovation, and leadership.

Open to all retail banks operating in Asia, the awards programme features categories covering retail products, digital banking initiatives, customer experience enhancements, and more. Don’t miss the opportunity to gain recognition for your achievements in retail banking.

We look forward to seeing you at the Awards Dinner on 2 July 2026 at the Marina Bay Sands Expo & Convention Centre!

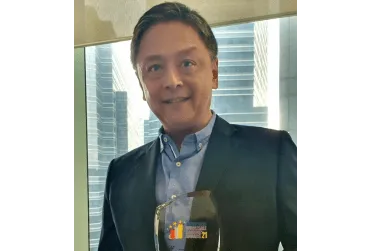

Testimonials

What do our winners have to say about winning the award?

Anurag Mathur Head of Retail Banking, Wealth Management, HSBC Bank (Singapore)

We keep customers at the centre of everything that we do, which I think is a big part of our success. We are very happy with the recognition and will continue to focus and invest in Asia Pacific.

Anurag Mathur Head of Retail Banking, Wealth Management, HSBC Bank (Singapore)

Jovencio Hernandez President, PNB Savings Bank

It’s a very prestigious award and we are very happy that one of our products landed in one of those awards you are giving out. We always look forward to this event yearly. I think the awardees that you are getting are good names in the industry, both local and international.

Jovencio Hernandez President, PNB Savings Bank

Prassanee Ouiyamaphan Executive Vice President, Head of Non Branch Channels, Bangkok Bank

It's a great honour for us to receive this award because it is a good testament to what we have done so far.

Prassanee Ouiyamaphan Executive Vice President, Head of Non Branch Channels, Bangkok Bank

Dennis Khoo Managing Director & Regional Head of Banking Head of Group Retail Strategic Transformation Office, UOB

Very excited for the award and thank you very much for giving us the recognition. It's really a testimony of our focus on customers and innovation.

Dennis Khoo Managing Director & Regional Head of Banking Head of Group Retail Strategic Transformation Office, UOB

Watch videos from past winners

ABF Retail Banking Awards 2024 Winner: United Overseas Bank Limited

ABF Retail Banking Awards 2024 Winner: Standard Chartered Bank - Tracy Wong Harris

ABF Retail Banking Awards 2024 Winner: Standard Chartered Bank - Florence Wong

ABF Retail Banking Awards 2024 Winner: Standard Chartered Hong Kong - Mona Sengupta

Photo Gallery

In the Press

Palawan Group of Companies' Commitment to Financial Inclusion and Innovation Lauded at the ABF Fintech and Retail Awards 2024

Jul 16, 2024Why should you enter

NETWORK

Winners will receive an exclusive invitation to the prestigious awards dinner in Singapore, offering a prime opportunity to celebrate well-deserved accolades!

AMPLIFY

Award winners can amplify their success by leveraging the influential platform of Asian Banking & Finance magazine to showcase achievements, innovative practices, and success stories, further strengthening their industry leadership and reputation.

RECOGNITION

The award serves as a prestigious accolade, celebrating exceptional accomplishments and elevating industry standing, while providing a powerful testament to excellence.

NEWS

HSBC China takes wealth management to new heights

Guidelines and Criteria

CATEGORIES

BANK OF THE YEAR/FINANCE COMPANY OF THE YEAR

The following awards will be given per country.

- Domestic Retail Bank of the Year

- International Retail Bank of the Year

- Mid-sized Retail Bank of the Year

- Digital Bank of the Year

- Private Bank of the Year

- Private Wealth Bank of the Year

- Virtual Bank of the Year

- New Virtual Bank of the Year

- Rural/Cooperative Bank of the Year

- SME Bank of the Year

- Finance Company of the Year

- Remittance Company of the Year

- Remittance Bank of the Year

SUPPORTING PROJECTS

The following awards will be given per country.

- Agent Banking Initiative of the Year

- AI & Machine Learning Initiative of the Year

- Analytics Initiative of the Year

- Asset Management Platform of the Year

- Automobile Lending Initiative of the Year

- Banking for Women Initiative of the Year

- Branch Innovation of the Year

- Call Centre Initiative of the Year

- Compliance Initiative of the Year

- Consumer Finance Product of the Year

- Core Banking System Initiative of the Year

- Credit Card Initiative of the Year

- Cross-Border Payments Initiative of the Year

- Data Governance Initiative of the Year

- Debit Card Initiative of the Year

- Digital Business Banking Initiative

- Digital Consumer Banking Initiative

- Digital Transformation of the Year

- Digital Wallet Initiative of the Year

- Ecosystem Initiative of the Year

- Embedded Finance Initiative of the Year

- Employer Award of the Year

- ESG Program of the Year

- Financial Inclusion Initiative of the Year

- Fraud Initiative of the Year

- Gen Z Product of the Year

- Gold and Precious Metals Bank of the Year

- Health and Wellness Initiative of the Year

- Insurance Product Innovation of the Year

- Internal Environmental Initiative of the Year

- External Environmental Initiative of the Year

- Internal Social Initiative of the Year

- External Social Initiative of the Year

- Internal Governance Initiative of the Year

- External Governance Initiative of the Year

- Investment Product Innovation of the Year

- Islamic Banking Initiative of the Year

- Islamic Wealth Management Platform of the Year

- Marketing & Brand Initiative of the Year

- Millennial product Initiative of the Year

- Mobile Banking & Payment Initiative of the Year

- Mortgage and Home Loan Product of the Year

- New Consumer Lending Product of the Year

- New SME Lending Product of the Year

- Online Securities Platform of the Year

- Open Banking Initiative of the Year

- Priority Banking Initiative of the Year

- Private Bank of the Year

- Retirement Solutions of the Year

- Regulation Initiative of the Year

- Risk Management Initiative of the Year

- Robotic Process Automation Initiative of the Year

- Savings Product of the Year

- Senior Citizen Product Initiative of the Year

- Service Innovation of the Year

- SME Community Support of the Year

- SME Digital Innovation of the Year

- SME Financial Inclusion Initiative of the Year

- SME FX Financial Inclusion Initiative of the Year

- SME Green Financing of the Year

- SME Payment Solutions of the Year

- Start-up Banking Initiative of the Year

- Strategic Partnership of the Year

- Structured Products Platform of the Year

- Sustainability Initiative of the Year

- Swift Initiative of the Year

- Wealth Management Platform of the Year

- Website of the Year

GUIDELINES

1. Nomination is open to all retail banks and finance companies in Asia.

2. Each can nominate up to 3 categories only.

Important: For Retail Bank of the Year category, each bank is only allowed to nominate for either International Bank OR Domestic Bank.

3. Awards will be judged by a esteemed industry experts committee based on nominations received.

4. Each nomination form is valid for 1 entry only. If you are nominating for several categories, please enter each entry separately.

5. The nomination is free of charge. Should you win, by opting for one of the winners package option below, you can secure your seats at the prestigious awards dinner and gain access to a wide range of valuable benefits.

ELIGIBILITY

1. For entries that will be entered for the BANK OF THE YEAR/FINANCE COMPANY OF THE YEAR, the nomination must demonstrate an overall significant success and accomplishments achieved over the last 12 calendar months of 2025.

2. For entries that will be entered for SUPPORTING PROJECTS, you must nominate a project, product, service or initiative that was:

- Launched over the last 12 calendar months of 2025, either in part or full.

- Launched prior to 2025 but had recent innovations to improve or develop the project, product, service or initiative

CRITERIA FOR JUDGING

For entries that will be entered for the BANK OF THE YEAR/FINANCE COMPANY OF THE YEAR category:

1. Achievements:

- What tangible accomplishments and milestones has the retail bank or finance company attained, including financial performance, market share growth, successful product launches, and expansion into new markets?

- How does the assessment of achievements provide a comprehensive snapshot of the institution's success and its ability to effectively execute strategic initiatives?

2. Challenges & Solutions:

- How does the bank or finance company showcase its ability to navigate and overcome obstacles within the industry, considering challenges such as market fluctuations, regulatory changes, or competitive pressures?

- Can you provide information on the institution's strategic responses and the effectiveness of the solutions implemented to address these challenges?

3. Innovation:

- How does the institution demonstrate its commitment to pioneering novel ideas, products, and services within the finance sector?

- In what ways does the assessment of innovation go beyond the introduction of innovative solutions and include the overall culture of innovation within the organization?

For entries that will be entered for the SUPPORTING PROJECTS categories

1. Uniqueness and Innovation:

- Does the bank or company demonstrate a commitment to pushing boundaries and introducing groundbreaking products, services, and initiatives that set them apart from competitors?

- Can you provide examples of innovations that have played a significant role in staying relevant, attracting new customers, and ensuring that the institution remains at the forefront of emerging trends?

2. Effectiveness and Impact:

- How well do the bank's products and services meet the needs of its customers, providing value and satisfaction?

- In what ways has the institution influenced and advanced industry standards, contributed to innovation, and fostered healthy competition within the broader industry?

3. Dynamism:

- How does the institution demonstrate agility, adaptability, and responsiveness to change?

- Can you provide examples of how the retail bank or finance company has navigated dynamic market conditions, embraced emerging technologies, and proactively adjusted strategies to meet evolving customer needs?

HOW TO ENTER?

1. Go to the online nomination form.

- Read the award entry guidelines and eligibility for your reference.

- Fill out the company information and entrant details fields.

- Choose the category you'd like to enter.

- Provide project information: Project title, 500-word summary of the entry, and client testimonial/s (if any).

2. You will then receive an email confirmation from the ABF Awards organisers after your nomination has been received.

3. To substantiate your entry, send supporting documents or photos to [email protected].

- Supporting documents and photos must be in PDF, PowerPoint and/or JPG format

- For supporting videos, Youtube.com or Vimeo.com links must be provided.

Past Winners

ABA Bank

Domestic Retail Bank of the Year - CambodiaAditya Birla Capital Limited

Financial Inclusion Initiative of the Year - India

Marketing & Brand Initiative of the Year - IndiaAditya Birla Housing Finance Limited

Analytics Initiative of the Year - India

Digital Transformation of the Year - IndiaAirstar Bank

Service Innovation of the Year - Hong KongAlliance Bank Malaysia Berhad

Open Banking Initiative of the Year - Malaysia

SME Financial Inclusion Initiative of the Year - MalaysiaAllied Bank Limited

External Environmental Initiative of the Year - PakistanAlrajhi Bank

Domestic Retail Bank of the Year - Saudi ArabiaAsialink Finance Corporation

Finance Company of the Year - Philippines

SME Financial Inclusion Initiative of the Year - PhilippinesBahrain Development Bank

SME Bank of the Year - Bahrain

SME Digital Innovation of the Year - BahrainBahrain Islamic Bank

Credit Card Initiative of the Year - Bahrain

Marketing & Brand Initiative of the Year - BahrainBaiduri Bank

Domestic Retail Bank of the Year - BruneiBank Danamon Indonesia

Debit Card Initiative of the Year - IndonesiaBank for Investment and Development of Vietnam

SME Bank of the Year - VietnamBank Islam Malaysia Berhad

Islamic Retail Bank of the Year - Malaysia

Islamic Wealth Management Platform of the Year - MalaysiaBank of Ayudhya PCL.

Marketing & Brand Initiative of the Year - ThailandBank of China (Hong Kong) Limited

SME Community Support of the Year - Hong KongBank of Singapore

Risk Management Initiative of the Year - SingaporeBank of the Philippine Islands

Customer Experience Initiative of the Year - Philippines

New Consumer Lending Product of the Year - Philippines

ESG Program of the Year - Philippines

Open Banking Initiative of the Year - Philippines

Sustainability Initiative of the Year - PhilippinesBank Simpanan Nasional

Financial Inclusion Initiative of the Year - MalaysiaBank SinoPac

Mobile Banking & Payment Initiative of the Year - Taiwan

Branch Innovation of the Year - Taiwan

AI & Machine Learning Initiative of the Year - TaiwanBank Syariah Indonesia

Service Innovation of the Year - IndonesiaBPI Direct BanKo, Inc.

SME Community Support of the Year - PhilippinesBDO Foundation

Financial Inclusion Initiative of the Year - PhilippinesBDO Unibank Inc.

Retirement Solutions of the Year - Philippines

Investment Product Innovation of the Year - PhilippinesBTN Prospera

Millennial Product Initiative of the Year - IndonesiaCambodian Public Bank PLC

SME Bank of the Year - CambodiaCathay Financial Holdings Co., Ltd.

Analytics Initiative of the Year - TaiwanCathay United Bank

Customer Experience Initiative of the Year - Taiwan

Debit Card Initiative of the Year - Taiwan

Investment Product Innovation of the Year - TaiwanCebuana Lhuillier Rural Bank Inc.

Rural/Cooperative Bank of the Year - PhilippinesChina Banking Corporation

Banking for Women Initiative of the Year - Philippines

Service Innovation of the Year - PhilippinesCIMB

Call Centre Initiative of the Year - Malaysia

Domestic Retail Bank of the Year - Malaysia

Wealth Management Platform of the Year - MalaysiaCIMB Bank Berhad

SME Digital Innovation of the Year - MalaysiaCIMB Bank Philippines

Strategic Partnership of the Year - PhilippinesCIMB Singapore

Strategic Partnership of the Year - SingaporeCitizen Development Business Finance PLC

AI & Machine Learning Initiative of the Year - Sri LankaCitizen Development Business Finance PLC

Automobile Lending Initiative of the Year - Sri LankaCommercial Bank of Ceylon PLC

Private Bank of the Year - Sri Lanka

SME Bank of the Year - Sri LankaCTBC Bank

Domestic Retail Bank of the Year - Taiwan

Fraud Initiative of the Year - Taiwan

Private Bank of the Year - TaiwanDBS Bank (Hong Kong) Limited

Customer Experience Initiative of the Year - Hong KongDBS Bank (Hong Kong) Limited

Digital Consumer Banking Initiative of the Year - Hong KongDBS Indonesia

Gen Z Product of the Year - Indonesia

Private Wealth Bank of the Year - IndonesiaDNSE Securities

Investment Product Innovation of the Year - Vietnam

Online Securities Platform of the Year - VietnamE.SUN Bank

Digital Wallet Initiative of the Year - TaiwanEast West Banking Corporation

Analytics Initiative of the Year - Philippines

Mid-sized Retail Bank of the Year - PhilippinesEmirates NBD

Credit Card Initiative of the Year - UAE

Digital Wallet Initiative of the Year - UAEF88

External Social Initiative of the Year - Vietnam

Sustainability Initiative of the Year - VietnamFar Eastern International Bank

ESG Program of the Year - TaiwanForteBank

Domestic Retail Bank of the Year - Kazakhstan

SME Bank of the Year - KazakhstanGulf Bank

Sustainability Initiative of the Year - KuwaitGX Bank Berhad

Virtual Bank of the Year - Malaysia

AI & Machine Learning Initiative of the Year - MalaysiaHang Seng Bank

Domestic Retail Bank of the Year - Hong Kong

Financial Inclusion Initiative of the Year - Hong Kong

AI & Machine Learning Initiative of the Year - Hong Kong

Analytics Initiative of the Year - Hong KongHNB Finance

Marketing & Brand Initiative of the Year - Sri LankaHo Chi Minh City Development Joint Stock Commercial Bank (HDBank)

Marketing & Brand Initiative of the Year - Vietnam

Mid-Sized Domestic Retail Bank of the Year - VietnamHome Credit Vietnam Finance Company Limited

Customer Experience Initiative of the Year - Vietnam

Finance Company of the Year - VietnamHong Leong Bank Berhad

Digital Transformation of the Year - Malaysia

SME Bank of the Year - MalaysiaHong Leong Finance

ASEAN Finance Company of the YearHSBC

Credit Card Initiative of the Year - Hong Kong

Marketing & Brand Initiative of the Year - Hong Kong

Wealth Management Platform of the Year - Hong KongHSBC Bank (China) Company Limited

International Retail Bank of the Year - Mainland China

Wealth Management Platform of the Year - Mainland ChinaHSBC Bank (Singapore) Limited

Investment Product Innovation of the Year - Singapore

Mobile Banking & Payment Initiative of the Year - SingaporeHSBC Bank (Vietnam) Ltd

International Retail Bank of the Year - VietnamHSBC India

Data Governance Initiative of the Year - IndiaHSBC Malaysia

Customer Experience Initiative of the Year - MalaysiaHSBC Philippines

International Retail Bank of the Year - Philippines

Employer Award of the Year - PhilippinesHSBC Taiwan

Credit Card Initiative of the Year - Taiwan

International Retail Bank of the Year - Taiwan

Structured Products Platform of the Year - TaiwanIDFC FIRST Bank Limited

Mobile Banking & Payment Initiative of the Year - IndiaInCred Financial Services Limited

Finance Company of the Year - IndiaIndovina Bank Ltd.

SME Community Support of the Year - Vietnam

Strategic Partnership of the Year - VietnamIpoteka Bank OTP Group

ESG Program of the Year - UzbekistanJoint Stock Commercial Bank for Foreign Trade of Viet Nam (VCB)

Risk Management Initiative of the Year - VietnamJSCB Uzbek Industrial and Construction Bank

Domestic Retail Bank of the Year - Uzbekistan

Digital Transformation of the Year - Uzbekistan

Risk Management Initiative of the Year - UzbekistanKasikornbank Public Company Limited

Mortgage and Home Loan Product of the Year - ThailandLand Bank of the Philippines

Domestic Retail Bank of the Year - PhilippinesMalayan Banking Berhad (Maybank)

Mobile Banking & Payment Initiative of the Year - MalaysiaMariBank Singapore Private Limited

SME Financial Inclusion Initiative of the Year - SingaporeMashreq

Digital Transformation of the Year - UAE

New Consumer Lending Product of the Year - UAE

Open Banking Initiative of the Year - UAE

Customer Experience Initiative of the Year - UAEMashreq Bank

Insurance Product Innovation of the Year - UAEMashreq Bank P.S.C.

SME Bank of the Year - UAE

SME Digital Innovation of the Year - UAEMashreq Private Banking

Private Bank of the Year - UAE

Wealth Management Platform of the Year - UAEMaya

Virtual Bank of the Year - PhilippinesMaybank

Digital Consumer Banking Initiative of the Year - Malaysia

Private Bank of the Year - MalaysiaMaybank (Cambodia) Plc.

Financial Inclusion Initiative of the Year - Cambodia

International Retail Bank of the Year - CambodiaMaybank Investment Bank Berhad

Investment Product Innovation of the Year - Malaysia

Online Securities Platform of the Year - MalaysiaMaybank Philippines, Inc.

Digital Consumer Banking Initiative of the Year - PhilippinesMaybank Singapore

Islamic Banking Initiative of the Year - Singapore

Priority Banking Initiative of the Year - SingaporeMB Bank (Cambodia) PLC

Mid-sized Retail Bank of the Year - CambodiaMox Bank

Digital Bank of the Year - Hong KongMyanmar Citizens Bank

Credit Card Initiative of the Year - Myanmar

Risk Management Initiative of the Year - MyanmarNam A Commercial Joint Stock Bank ( NAM A BANK )

Credit Card Initiative of the Year - Vietnam

Mobile Banking & Payment Initiative of the Year - VietnamNational Bank of Ras Al-Khaimah

Analytics Initiative of the Year - UAENational Development Bank PLC

Domestic Retail Bank of the Year - Sri Lanka

Islamic Banking Initiative of the Year - Sri LankaNational Finance Co.

Finance Company of the Year - OmanNepal SBI Bank Limited

Digital Business Banking Initiative of the Year - Nepal

SME Bank of the Year - NepalOCBC

ASEAN SME Bank of the Year

SME Bank of the Year - Hong KongOCBC Bank (Malaysia) Berhad

Branch Innovation of the Year - Malaysia

Private Wealth Bank of the Year - MalaysiaOCBC Indonesia

SME Bank of the Year - IndonesiaOCBC Securities

Online Securities Platform of the Year - SingaporeOCBC Securities APAC

Asset Management Platform of the Year - SingaporeOCBC Singapore

Cross-Border Payments Initiative of the Year - Singapore

Sustainability Initiative of the Year - SingaporeORIX METRO Leasing and Finance Corporation

Automobile Lending Initiative of the Year - PhilippinesPalawan Group of Companies

Digital Transformation of the Year - PhilippinesPerbadanan TAIB

Digital Transformation of the Year - Brunei

Islamic Banking Initiative of the Year - BruneiPLUS by BTN Prioritas

Customer Experience Initiative of the Year - IndonesiaPrimeCredit Limited

Finance Company of the Year - Hong KongPrince Bank PLC

Internal Governance Initiative of the Year - CambodiaPT Bank Central Asia Tbk (BCA)

External Social Initiative of the Year - IndonesiaPT Bank HSBC Indonesia

International Retail Bank of the Year - Indonesia

Priority Banking Initiative of the Year - Indonesia

Core Banking System Initiative of the Year - IndonesiaPT Bank Mandiri (Persero) Tbk

AI & Machine Learning Initiative of the Year - Indonesia

Digital Transformation of the Year - Indonesia

Private Bank of the Year - IndonesiaPT Bank Maybank Indonesia Tbk

Sustainability Initiative of the Year - Indonesia

SME Digital Innovation of the Year - Indonesia

Islamic Banking Initiative of the Year - Indonesia

Wealth Management Platform of the Year - IndonesiaPT Bank Permata Tbk

Domestic Retail Bank of the Year - Indonesia

Mobile Banking & Payment Initiative of the Year - IndonesiaPT Bank Rakyat Indonesia (Persero) Tbk

Financial Inclusion Initiative of the Year- IndonesiaPT Bank Seabank Indonesia

Virtual Bank of the Year - Indonesia

Ecosystem Initiative of the Year - IndonesiaPT Bank SMBC Indonesia Tbk

Digital Business Banking Initiative of the Year - IndonesiaPT Jalin Pembayaran Nusantara

Payment Infrastructure Platform of the Year - IndonesiaPT Maybank Sekuritas Indonesia

Investment Product Innovation of the Year - IndonesiaPT. Bank Tabungan Negara (Persero) Tbk.

Branch Innovation of the Year - IndonesiaPublic Bank Berhad

Automobile Lending Initiative of the Year - Malaysia

Sustainability Initiative of the Year - MalaysiaPublic Islamic Bank Berhad

Islamic Banking Initiative of the Year - MalaysiaQatar Islamic Bank (QIB)

Domestic Retail Bank of the Year - Qatar

Financial Inclusion Initiative of the Year - QatarRAKBANK

Call Centre Initiative of the Year - UAE

Compliance Initiative of the Year - UAE

Service Innovation of the Year - UAERHB Bank Berhad

Debit Card Initiative of the Year - Malaysia

ESG Program of the Year - Malaysia

Internal Environmental Initiative of the Year - MalaysiaRHB Banking Group

Risk Management Initiative of the Year - MalaysiaRHB Singapore

Mid-sized Retail Bank of the Year - SingaporeRizal Commercial Banking Corporation

New SME Lending Product of the Year - Philippines

Online Foreign Exchange Platform of the Year - Philippines

Remittance Company of the Year - Philippines

SME FX Financial Inclusion Initiative of the Year - Philippines

Agent Banking Initiative of the Year - Philippines

Gen Z Product of the Year - PhilippinesSacombank

SME Payment Solutions of the Year - VietnamSaigon-Hanoi Commercial Joint Stock Bank

Health and Wellness Initiative of the Year - Vietnam

Internal Social Initiative of the Year - VietnamSaudi National Bank

Credit Card Initiative of the Year - Saudi Arabia

Customer Experience Initiative of the Year - Saudi ArabiaSB Finance, Inc.

Marketing & Brand Initiative of the Year - PhilippinesSecurity Bank Corporation

Mobile Banking & Payment Initiative of the Year - Philippines

Consumer Finance Product of the Year - Philippines

Credit Card Initiative of the Year - Philippines

SME Bank of the Year - Philippines

External Environmental Initiative of the Year - PhilippinesSeylan Bank PLC

Call Centre Initiative of the Year - Sri Lanka

Customer Experience Initiative of the Year - Sri LankaShanghai Commercial Bank

Digital Transformation of the Year - Hong Kong

SME Digital Innovation of the Year - Hong KongSiam Commercial Bank

AI & Machine Learning Initiative of the Year - Thailand

Domestic Retail Bank of the Year - ThailandSiam Digital Lending Company

Start-up Banking Initiative of the Year - ThailandSkiply - RAK Bank

Mobile Banking & Payment Initiative of the Year - UAEStandard Chartered Bank

AI & Machine Learning Initiative of the Year - Singapore

International Retail Bank of the Year - Singapore

Marketing & Brand Initiative of the Year - SingaporeStandard Chartered Bank

Wealth Management Platform of the Year - BahrainStandard Chartered Bank

Investment Product Innovation of the Year - India

Wealth Management Platform of the Year - IndiaStandard Chartered Bank (Hong Kong) Limited

International Retail Bank of the Year - Hong Kong

Employer of the Year - Hong Kong

ESG Program of the Year - Hong KongStandard Chartered Bank (Taiwan) Limited

Internal Social Initiative of the Year - Taiwan

Wealth Management Platform of the Year - Taiwan

Digital Consumer Banking Initiative of the Year - TaiwanStandard Chartered Bank Brunei

International Retail Bank of the Year - BruneiStandard Chartered Bank Malaysia Berhad

Priority Banking Initiative of the Year - MalaysiaTaishin International Bank

New Consumer Lending Product of the Year - Taiwan

Service Innovation of the Year - Taiwan

Strategic Partnership of the Year - TaiwanTaiwan Business Bank (TBB)

Financial Inclusion Initiative of the Year - Taiwan

Digital Transformation of the Year - TaiwanTerraPay

Digital Wallet Initiative of the Year - SingaporeThe Bank of East Asia, Limited

Branch Innovation of the Year - Hong Kong

Priority Banking Initiative of the Year - Hong KongThe Bank of Punjab

SME Bank of the Year - PakistanThunes

Payment Infrastructure Platform of the Year - SingaporeTrust Bank Singapore

Virtual Bank of the Year - Singapore

Digital Consumer Banking Initiative of the Year- SingaporeUAB Bank Limited

Mid-sized Domestic Retail Bank of the Year - Myanmar

Sustainability Initiative of the Year - MyanmarUnited Bank Limited (UBL)

Customer Experience Initiative of the Year - Pakistan

Digital Transformation of the Year - PakistanUnited Overseas Bank (Malaysia) Bhd

Digital Business Banking Initiative of the Year - Malaysia

International Retail Bank of the Year - MalaysiaUnited Overseas Bank Limited

Branch Innovation of the Year - Singapore

Digital Transformation of the Year - Singapore

Domestic Retail Bank of the Year - Singapore

Customer Experience Initiative of the Year - Singapore

Health and Wellness Initiative of the Year - Singapore

Fraud Initiative of the Year - Singapore

Credit Card Initiative of the Year - SingaporeUOB Indonesia

Digital Consumer Banking Initiative of the Year - Indonesia

Marketing & Brand Initiative of the Year - IndonesiaUOB Thailand

Branch Innovation of the Year - Thailand

Employer Award of the Year - Thailand

International Retail Bank of the Year - ThailandVattanac Bank

Call Centre Initiative of the Year - Cambodia

Digital Consumer Banking Initiative of the Year - CambodiaVietnam Prosperity Joint-Stock Commercial Bank (VPBank)

Banking for Women Initiative of the Year - Vietnam

Priority Banking Initiative of the Year - VietnamVietnam Technological and Commercial Joint Stock Bank (Techcombank)

Domestic Retail Bank of the Year - Vietnam

Digital Business Banking Initiative of the Year - Vietnam

SME Digital Innovation of the Year - VietnamViettel Money

AI & Machine Learning Initiative of the Year - Vietnam

Financial Inclusion Initiative of the Year - VietnamWhalet

SME Payment Solutions of the Year - Singapore

- Domestic Retail Bank of the Year - Cambodia

Aditya Birla Capital Digital

- Ecosystem Initiative of the Year - India

ahlibank

- Private Wealth Bank of the Year - Oman

Airstar Bank

- Digital Business Banking Initiative of the Year - Hong Kong

Alliance Bank Malaysia Berhad

- Digital Business Banking Initiative of the Year - Malaysia

- Open Banking Initiative of the Year - Malaysia

AmBank (M) Berhad

- Fraud Initiative of the Year - Malaysia

- Priority Banking Initiative of the Year - Malaysia

AmBank Group

- SME Digital Innovation of the Year - Malaysia

Ant Bank (Hong Kong) Limited

- Consumer Finance Product of the Year - Hong Kong

- New Virtual Bank of the Year - Hong Kong

Ardshinbank CJSC

- Domestic Retail Bank of the Year - Armenia

- Private Bank of the Year - Armenia

Asialink Finance Corporation

- SME Financial Inclusion Initiative of the Year - Philippines

Axis Bank

- Digital Wallet Initiative of the Year - India

Baiduri Bank

- Domestic Retail Bank of the Year - Brunei

Bank for Investment and Development of Vietnam

- SME Bank of the Year - Vietnam

Bank of Ayudhya (Kept by krungsri)

- Gen Z Product of the Year - Thailand

Bank of Ayudhya (Krungsri)

- Marketing & Brand Initiative of the Year - Thailand

- SME Digital Innovation of the Year - Thailand

- SME Financial Inclusion Initiative of the Year - Thailand

Bank of China (Hong Kong)

- Credit Card Initiative of the Year - Hong Kong

Bank of East Asia

- Digital Consumer Banking Initiative of the Year - Hong Kong

- Mobile Banking & Payment Initiative of the Year - Hong Kong

Bank of the Philippine Islands

- Customer Experience Initiative of the Year - Philippines

- Digital Consumer Banking Initiative of the Year - Philippines

- ESG Program of the Year - Silver

- Open Banking Initiative of the Year - Philippines

Bank SinoPac

- AI & Machine Learning Initiative of the Year - Taiwan

- Digital Wallet Initiative of the Year - Taiwan

- Ecosystem Initiative of the Year - Taiwan

Bank Syariah Indonesia

- Online Fund Accounts Services of the Year - Indonesia

- Financial Inclusion Initiative of the Year - Philippines

- Private Bank of the Year - Philippines

- Retirement Solutions of the Year - Philippines

BigPay

- Ecosystem Initiative of the Year - Malaysia

- Financial Inclusion Initiative of the Year - Malaysia

BPI Direct BanKo

- New SME Lending Product of the Year - Philippines

Cathay United Bank

- Fraud Initiative of the Year - Taiwan

- Mortgage and Home Loan Product of the Year - Taiwan

- Service Innovation of the Year - Taiwan

- Investment Product Innovation of the Year - Taiwan

CB Bank

- SME Bank of the Year - Myanmar

Cebuana Lhuillier Bank

- Rural/Cooperative Bank of the Year - Philippines

China Banking Corporation

- Domestic Retail Bank of the Year - Philippines

CIMB Bank Berhad

- AI & Machine Learning Initiative of the Year - Malaysia

- Customer Experience Initiative of the Year - Malaysia

- Digital Consumer Banking Initiative of the Year - Malaysia

- SME Financial Inclusion Initiative of the Year - Malaysia

CIMB Bank Philippines

- Service Innovation of the Year - Philippines

CIMB Niaga

- SME Financial Inclusion Initiative of the Year - Indonesia

CIMB Singapore

- Strategic Partnership of the Year - Singapore

CIMB Thai PCL

- Wealth Management Platform of the Year - Thailand

Commercial Bank of Ceylon PLC

- Digital Consumer Banking Initiative of the Year - Sri Lanka

- SME Bank of the Year - Sri Lanka

Commercial Bank of Kuwait

- Digital Transformation of the Year - Kuwait

creFIT

- Digital Business Financing Initiative of the Year - Hong Kong

CTBC Bank

- Domestic Retail Bank of the Year - Taiwan

- SME Bank of the Year - Taiwan

DBS Bank (Hong Kong) Ltd

- Customer Experience Initiative of the Year - Hong Kong

DNSE Securities

- Investment Product Innovation of the Year - Vietnam

- Online Securities Platform of the Year - Vietnam

- Customer Experience Initiative of the Year - Taiwan

- Digital Transformation of the Year - Taiwan

East West Banking Corporation

- Mobile Banking & Payment Initiative of the Year - Philippines

Emirates NBD

- Mobile Banking & Payment Initiative of the Year - UAE

- Virtual Bank of the Year - UAE

F88 Business joint stock company

- Customer Experience Initiative of the Year - Vietnam

First Circle

- SME Digital Innovation of the Year - Philippines

Fubon Bank (Hong Kong)

- Data Governance Initiative of the Year - Hong Kong

- Digital Transformation of the Year - Hong Kong

GX Bank Berhad

- Analytics Initiative of the Year - Malaysia

GXS Bank Pte Ltd

- Customer Experience Initiative of the Year - Singapore

Habib Bank AG Zurich

- Islamic Banking Initiative of the Year - Pakistan

- Marketing & Brand Initiative of the Year - Pakistan

Habib Bank Limited

- SME Payment Solutions of the Year - Pakistan

Hang Seng Bank

- Analytics Initiative of the Year - Hong Kong

- Branch Innovation of the Year - Gold

- Domestic Retail Bank of the Year - Hong Kong

- Financial Inclusion Initiative of the Year - Hong Kong

HNB Finance PLC

- Marketing & Brand Initiative of the Year - Sri Lanka

Ho Chi Minh City Development Joint Stock Commercial Bank (HDBank)

- Mobile Banking & Payment Initiative of the Year - Vietnam

- Mid-sized Domestic Retail Bank of the Year - Vietnam

Home Credit Philippines (HC Consumer Finance Philippines, Inc.)

- Finance Company of the Year - Philippines

Home Credit Vietnam

- Consumer Finance Product of the Year - Vietnam

Hong Leong Bank Malaysia

- SME Bank of the Year - Malaysia

Hong Leong Finance

- ASEAN Finance Company of the Year

HSBC

- Analytics Initiative of the Year - India

- Marketing & Brand Initiative of the Year - Hong Kong

- Wealth Management Platform of the Year - Hong Kong

HSBC Bangladesh

- International Retail Bank of the Year - Bangladesh

- Marketing & Brand Initiative of the Year - Bangladesh

HSBC Bank (Singapore) Limited

- Credit Card Initiative of the Year - Singapore

- Digital Transformation of the Year - Singapore

HSBC Bank (Taiwan) Limited

- Wealth Banking Initiative of the Year - Taiwan

HSBC Bank (Vietnam) Ltd.

- Credit Card Initiative of the Year - Vietnam

- Priority Banking Initiative of the Year - Vietnam

HSBC China

- Branch Innovation of the Year - Silver

- International Retail Bank of the Year - Mainland China

HSBC Philippines

- Employer Award of the Year - Bronze

- International Retail Bank of the Year - Philippines

- Marketing & Brand Initiative of the Year - Philippines

Hugosave (Atlas Consolidated Pte Ltd)

- Financial Inclusion Initiative of the Year - Singapore

IDFC FIRST Bank

- Financial Inclusion Initiative of the Year - India

- Automobile Lending Initiative of the Year - India

- Digital Consumer Banking Initiative of the Year - India

Industrial Bank of Korea

- Domestic Retail Bank of the Year - South Korea

Joint Stock Commercial Bank for Foreign Trade of Viet Nam (VCB)

- Risk Management Initiative of the Year - Vietnam

Jordan Kuwait Bank

- AI & Machine Learning Initiative of the Year - Jordan

KASIKORNBANK

- Analytics Initiative of the Year - Thailand

- Fraud Initiative of the Year - Thailand

KBZ Bank

- Financial Inclusion Initiative of the Year - Myanmar

- Gen Z Product of the Year - Myanmar

Krungthai Bank

- Strategic Partnership of the Year - Thailand

MariBank Singapore Private Limited

- Ecosystem Initiative of the Year - Singapore

- New Virtual Bank of the Year - Singapore

Mashreq

- Digital Consumer Banking Initiative of the Year - UAE

- Domestic Retail Bank of the Year - UAE

- Islamic Banking Initiative of the Year - UAE

- Open Banking Initiative of the Year - UAE

- SME Bank of the Year - UAE

Mashreq Private Banking

- Private Bank of the Year - UAE

Maya

- New Virtual Bank of the Year - Philippines

Maybank (Cambodia) Plc.

- International Retail Bank of the Year - Cambodia

- Marketing & Brand Initiative of the Year - Cambodia

Maybank Investment Bank Berhad

- Digital Transformation of the Year - Malaysia

- Online Securities Platform of the Year - Malaysia

Maybank Securities (Thailand) Public Company Limited

- Online Securities Platform of the Year - Thailand

Maybank Sekuritas Indonesia

- Investment Product Innovation of the Year - Indonesia

MBCambodia

- Mid-sized Domestic Retail Bank of the Year - Cambodia

- SME Financial Inclusion Initiative of the Year - Cambodia

Meezan Bank Limited

- Analytics Initiative of the Year - Pakistan

- Digital Business Banking Initiative of the Year - Pakistan

Mega International Commercial Bank

- Consumer Finance Product of the Year - Taiwan

- Risk Management Initiative of the Year - Taiwan

Moomoo Financial Singapore

- Investment Product Innovation of the Year - Singapore

Mox Bank Limited

- Investment Product Innovation of the Year - Hong Kong

- Virtual Bank of the Year - Hong Kong

Mutual Trust Bank PLC

- Digital Transformation of the Year - Bangladesh

- Open Banking Initiative of the Year - Bangladesh

Nam A Commercial Joint Stock Bank (NAM A BANK)

- Ecosystem Initiative of the Year - Vietnam

- Open Banking Initiative of the Year - Vietnam

National Development Bank PLC

- Banking for Women Initiative of the Year - Sri Lanka

- Domestic Retail Bank of the Year - Sri Lanka

Nepal SBI Bank Limited

- Digital Business Banking Initiative of the Year - Nepal

- SME Bank of the Year - Nepal

Newcastle Permanent

- Digital Consumer Banking Initiative of the Year - Australia

O-BANK

- SME Digital Innovation of the Year - Taiwan

OCBC Bank

- ASEAN SME Bank of the Year

- AI & Machine Learning Initiative of the Year - Singapore

- Mobile Banking & Payment Initiative of the Year - Singapore

- Fraud Initiative of the Year - Singapore

OCBC Securities Pte Ltd

- Online Securities Platform of the Year - Singapore

Palawan Group of Companies

- Finance Company Inclusion of the Year - Philippines

Pan Asia Banking Corporation

- Ecosystem Initiative of the Year - Sri Lanka

Philippine National Bank

- Rebranding Campaign of the Year - Philippines

PrimeCredit Limited

- Finance Company of the Year - Hong Kong

Prince Bank Plc.

- Internal Governance Initiative of the Year - Cambodia

PT Bank Aladin Syariah Tbk

- Islamic Banking Initiative of the Year - Indonesia

PT Bank Central Asia Tbk

- Fraud Initiative of the Year - Indonesia

PT Bank HSBC Indonesia

- International Retail Bank of the Year - Indonesia

PT Bank Mandiri (Persero) Tbk

- AI & Machine Learning Initiative of the Year - Indonesia

- Data Governance Initiative of the Year - Indonesia

- Digital Transformation of the Year - Indonesia

- Domestic Retail Bank of the Year - Indonesia

- Mobile Banking & Payment Initiative of the Year - Indonesia

- Private Bank of the Year - Indonesia

PT Bank Maybank Indonesia, Tbk

- Wealth Management Platform of the Year - Indonesia

PT Bank Negara Indonesia (Persero), Tbk

- Digital Business Banking Initiative of the Year - Indonesia

PT Bank OCBC NISP Tbk

- Consumer Finance Product of the Year - Indonesia

- Priority Banking Initiative of the Year - Indonesia

- SME Bank of the Year - Indonesia

PT Bank Rakyat Indonesia (Persero) Tbk.

- Marketing & Brand Initiative of the Year - Indonesia

PT Bank Tabungan Negara (Persero), Tbk

- Customer Experience Initiative of the Year - Indonesia

PT. Bank Woori Saudara Indonesia

- Digital Security Initiative of the Year - Indonesia

PT. JULO Teknologi Finansial (JULO)

- Financial Inclusion Initiative of the Year - Indonesia

- New Consumer Lending Product of the Year - Indonesia

Public Bank Berhad

- Automobile Lending Initiative of the Year - Malaysia

RAK Bank

- Fraud Initiative of the Year - UAE

- Website of the Year - UAE

RHB Bank Berhad

- Call Centre Initiative of the Year - Malaysia

- Domestic Retail Bank of the Year - Malaysia

RHB Singapore

- Mid-sized International Retail Bank of the Year - Singapore

Rizal Commercial Banking Corporation

- Automobile Lending Initiative of the Year - Philippines

- Consumer Finance Product of the Year - Philippines

- Debit Card Initiative of the Year - Philippines

- Digital Transformation of the Year - Philippines

- Remittance Company of the Year - Philippines

- SME Bank of the Year - Philippines

Saigon Thuong Tin Commercial Joint Stock Bank (Sacombank)

- SME Payment Solutions of the Year - Vietnam

SB Finance Inc.

- New Consumer Lending Product of the Year - Philippines

Security Bank Corporation

- Credit Card Initiative of the Year - Philippines

- ESG Program of the Year - Bronze

- Sustainability Initiative of the Year - Philippines

Shwe Bank

- Core Banking System Initiative of the Year - Myanmar

Siam Commercial Bank

- Automobile Lending Initiative of the Year - Thailand

- Domestic Retail Bank of the Year - Thailand

Skiply - RAKBANK (National Bank Of Ras Al Khaimah)

- Digital Transformation of the Year - UAE

SME Bank of Cambodia

- SME Bank of the Year - Cambodia

Social Islami Bank PLC

- Remittance Company of the Year - Bangladesh

- Senior Citizen Product Initiative of the Year - Bangladesh

SQB

- Domestic Retail Bank of the Year - Uzbekistan

- SME Bank of the Year - Uzbekistan

Standard Chartered Bank

- International Retail Bank of the Year - Bahrain

Standard Chartered Bank

- Digital Transformation of the Year - China

Standard Chartered Bank

- Customer Experience Initiative of the Year - India

- Wealth Management Platform of the Year - India

Standard Chartered Bank (Hong Kong) Limited

- Employer Award of the Year - Silver

- ESG Program of the Year - Gold

- International Retail Bank of the Year - Hong Kong

- Insurance Product Innovation of the Year - Hong Kong

- New Consumer Lending Product of the Year - Hong Kong

Standard Chartered Bank (Singapore) Limited

- International Retail Bank of the Year - Singapore

Standard Chartered Bank (Taiwan) Limited

- Digital Consumer Banking Initiative of the Year - Taiwan

- International Retail Bank of the Year - Taiwan

- Wealth Management Platform of the Year - Taiwan

Standard Chartered Bank Brunei

- International Retail Bank of the Year - Brunei

Standard Chartered Bank Malaysia Berhad

- Credit Card Initiative of the Year - Malaysia

- Debit Card Initiative of the Year - Malaysia

Standard Chartered Bank (Singapore) Limited

- Wealth Management Platform of the Year - Singapore

Standard Chartered Securities (B) Sdn Bhd

- Wealth Management Platform of the Year - Brunei

Standard Chartered Securities India

- Digital Transformation of the Year - India

- Online Securities Platform of the Year - India

Summit Capital Leasing

- Sustainability Initiative of the Year - Thailand

Taishin International Bank

- Financial Inclusion Initiative of the Year - Taiwan

- New Consumer Lending Product of the Year - Taiwan

Taiwan Business Bank

- Sustainability Initiative of the Year - Taiwan

TerraPay

- Strategic Partnership of the Year - India

- Website of the Year - India

The Bank of Punjab

- SME Bank of the Year - Pakistan

Tonik Digital Bank, Inc.

- Virtual Bank of the Year - Philippines

Trust Bank Singapore

- Virtual Bank of the Year - Singapore

UAB Bank Limited

- Mid-sized Domestic Retail Bank of the Year - Myanmar

- Mobile Banking & Payment Initiative of the Year - Myanmar

United Asia Finance Limited

- Digital Loan Financing Initiative of the Year - Hong Kong

United Bank Limited (UBL)

- Digital Transformation of the Year - Pakistan

- Mobile Banking & Payment Initiative of the Year - Pakistan

United Overseas Bank (Malaysia) Bhd

- International Retail Bank of the Year - Malaysia

- Mobile Banking & Payment Initiative of the Year - Malaysia

- Sustainability Initiative of the Year - Malaysia

United Overseas Bank (Thai) Company Limited

- Employer Award of the Year - Gold

- International Retail Bank of the Year - Thailand

United Overseas Bank Limited

- Banking for Women Initiative of the Year - Singapore

- Branch Innovation of the Year - Bronze

- Debit Card Initiative of the Year - Singapore

- Domestic Retail Bank of the Year - Singapore

- Health and Wellness Initiative of the Year - Singapore

- Marketing & Brand Initiative of the Year - Singapore

- SME Payment Solutions of the Year - Singapore

UOB Vietnam

- International Retail Bank of the Year - Vietnam

- Service Innovation of the Year - Vietnam

Vastu Housing Finance Corporation Limited

- Finance Company of the Year - India

Vattanac Bank

- Mobile Banking & Payment Initiative of the Year - Cambodia

Vietcombank Remittance Company

- Remittance Company of the Year - Vietnam

Vietnam Public Joint Stock Commercial Bank

- Digital Transformation of the Year - Vietnam

- SME Digital Innovation of the Year - Vietnam

Vietnam Technological and Commercial Joint Stock Bank (Techcombank)

- Digital Consumer Banking Initiative of the Year - Vietnam

- Domestic Retail Bank of the Year - Vietnam

Vikki Digital Bank

- New Virtual Bank of the Year - Vietnam

WeBank Co., Ltd.

- Virtual Bank of the Year - China

Welab

- AI & Machine Learning Initiative of the Year - Hong Kong

ZA Bank

- SME Digital Innovation of the Year - Hong Kong

Zenith Capital Credit Group Corporation

- Finance Company Initiative of the Year - Philippines

Abu Dhabi Commercial Bank

- SME Bank of the Year - UAE

- New SME Lending Product of the Year - UAE

Advanced Bank of Asia Limited (ABA Bank)

- Domestic Retail Bank of the Year - Cambodia

Affin Bank Berhad

- Mortgage and Home Loan Product of the Year - Malaysia

Airtel Payments Bank

- Digital Consumer Banking Initiative of the Year - India

- Employer Award of the Year - Bronze

Al Rajhi Banking & Investment Corporation (Malaysia) Bhd

- Virtual Bank of the Year - Malaysia

Alliance Bank Malaysia Berhad

- New Consumer Lending Product of the Year - Malaysia

- Financial Inclusion Initiative of the Year - Malaysia

AmBank Group

- Branch Innovation of the Year - Gold

- Mobile Banking & Payment Initiative of the Year - Malaysia

Ardshinbank CJSC

- Domestic Retail Bank of the Year - Armenia

Asialink Finance Corporation

- Finance Company of the Year - Philippines

- SME Financial Inclusion Initiative of the Year - Philippines

Axis Bank Limited

- Domestic Retail Bank of the Year - India

- Digital Transformation of the Year - India

Ayeyarwaddy Farmers Development Bank

- Remittance Company of the Year - Myanmar

Baiduri Bank

- Domestic Retail Bank of the Year - Brunei

Bank Aladin Syariah

- Islamic Banking Initiative of the Year - Indonesia

Bank of Ayudhya Public Company Limited

- Millennial Product Initiative of the Year - Thailand

- Financial Inclusion Initiative of the Year - Thailand

- AI & Machine Learning Initiative of the Year - Thailand

- Mobile Banking & Payment Initiative of the Year - Thailand

Bank of China (Hong Kong)

- SME Bank of the Year - Hong Kong

- Digital Business Banking Initiative of the Year - Hong Kong

- Mobile Banking & Payment Initiative of the Year - Hong Kong

- Digital Transformation of the Year - Hong Kong

Bank of the Philippine Islands

- ESG Program of the Year - Silver

Bank SinoPac

- Branch Innovation of the Year - Silver

- AI & Machine Learning Initiative of the Year - Taiwan

- Analytics Initiative of the Year - Taiwan

- Mobile Banking & Payment Initiative of the Year - Taiwan

BDO Foundation

- Financial Inclusion Initiative of the Year - Philippines

BDO Private Bank

- Private Bank of the Year - Philippines

BIDV

- SME Bank of the Year - Vietnam

Cambodia Public Bank

- SME Bank of the Year - Cambodia

Chip Mong Bank

- SME Financial Inclusion Initiative of the Year - Cambodia

Cathay United Bank

- Domestic Retail Bank of the Year - Taiwan

Cathay United Bank

- Insurance Product Innovation of the Year - Taiwan

CB Bank

- SME Bank of the Year - Myanmar

Cebuana Lhuillier Rural Bank, Inc.

- Rural/Cooperative Bank of the Year - Philippines

Chang Hwa Commercial Bank

- Banking for Women Initiative of the Year - Taiwan

CIMB Thai Bank Public Company Limited

- Wealth Management Platform of the Year - Thailand

- Analytics Initiative of the Year - Thailand

Commercial Bank of Ceylon PLC

- Digital Consumer Banking Initiative of the Year - Sri Lanka

- SME Bank of the Year - Sri Lanka

CIMB Bank Berhad

- SME Digital Innovation of the Year - Malaysia

CTBC Bank

- Strategic Partnership of the Year - Taiwan

- Credit Card Initiative of the Year - Taiwan

DNSE Securities

- Investment Product Innovation of the Year - Vietnam

- Online Securities Platform of the Year - Vietnam

E.SUN Bank

- Retirement Solutions of the Year - Taiwan

EMIRATES NBD

- Domestic Retail Bank of the Year - UAE

- Analytics Initiative of the Year - UAE

Eurasian Bank

- Domestic Retail Bank of the Year - Kazakhstan

Fam

- Start-up Banking Initiative of the Year - India

First Commercial Bank

- SME Bank of the Year - Taiwan

- Digital Business Banking Initiative of the Year - Taiwan

GoTyme Bank Corporation

- Debit Card Initiative of the Year - Philippines

- Digital Wallet Initiative of the Year - Philippines

Government Housing Bank, Thailand

- Mortgage and Home Loan Product of the Year - Thailand

Habib Bank Limited

- Analytics Initiative of the Year - Pakistan

- Digital Business Banking Initiative of the Year - Pakistan

- Digital Consumer Banking Initiative of the Year - Pakistan

Helicap

- SME Financial Inclusion Initiative of the Year - Singapore

HNB Finance PLC

- Marketing & Brand Initiative of the Year - Sri Lanka

Ho Chi Minh City Development Joint Stock Commercial Bank (HDBank)

- Sustainability Initiative of the Year - Vietnam

Hong Leong Bank Malaysia

- SME Bank of the Year - Malaysia

Hong Leong Finance

- ASEAN Finance Company of the Year

HSBC

- Financial Inclusion Initiative of the Year - Hong Kong

- Investment Product Innovation of the Year - Hong Kong

- Marketing & Brand Initiative of the Year - Hong Kong

- Strategic Partnership of the Year - Hong Kong

- Wealth Management Platform of the Year - Hong Kong

- Analytics Initiative of the Year - Hong Kong

HSBC PayMe

- Millennial Product Initiative of the Year - Hong Kong

HSBC Bangladesh

- International Retail Bank of the Year - Bangladesh

- Marketing & Brand Initiative of the Year - Bangladesh

HSBC Bank (Vietnam) Ltd.

- International Retail Bank of the Year - Vietnam

- Credit Card Initiative of the Year - Vietnam

HSBC Bank Australia Limited

- Consumer Finance Product of the Year - Australia

- Credit Card Initiative of the Year - Australia

- New Consumer Lending Product of the Year - Australia

HSBC China

- International Retail Bank of the Year - Mainland China

- AI & Machine Learning Initiative of the Year - Mainland China

HSBC India

- International Retail Bank of the Year - India

HSBC Philippines

- International Retail Bank of the Year - Philippines

- Wealth Management Platform of the Year - Philippines

HSBC Singapore

- Digital Transformation of the Year - Singapore

- Mortgage and Home Loan Product of the Year - Singapore

- Strategic Partnership of the Year - Singapore

HSBC Sri Lanka

- International Retail Bank of the Year - Sri Lanka

Hugosave (Atlas Consolidated Pte Ltd)

- Consumer Finance Product of the Year - Singapore

- Financial Inclusion Initiative of the Year - Singapore

Kasikorn Global Payment Co., Ltd.

- Strategic Partnership of the Year - Thailand

KASIKORNBANK PCL

- Consumer Finance Product of the Year - Thailand

- Digital Wallet Initiative of the Year - Thailand

KBZ Bank

- Domestic Retail Bank of the Year - Myanmar

- Core Banking System Initiative of the Year - Myanmar

Krungsri Auto under Bank of Ayudhya PLC.

- Automobile Lending Initiative of the Year - Thailand

Malayan Banking Berhad

- Marketing & Brand Initiative of the Year - Malaysia

Mashreq

- Service Innovation of the Year - UAE

Mashreq

- Digital Consumer Banking Initiative of the Year - UAE

- New Consumer Lending Product of the Year - UAE

Mashreq

- Wealth Management Platform of the Year - UAE

Maya

- Virtual Bank of the Year - Philippines

Maybank

- Digital Wallet Initiative of the Year - Malaysia

Maybank Cambodia

- International Retail Bank of the Year - Cambodia

Maybank Philippines, Inc.

- Strategic Partnership of the Year - Philippines

Meezan Bank

- Domestic Retail Bank of the Year - Pakistan

- AI & Machine Learning Initiative of the Year - Pakistan

- Meezan Bank Data Governance Initiative of the Year - Pakistan

Mega International Commercial Bank

- Consumer Finance Product of the Year - Taiwan

Military Commercial Joint Stock Bank (MB Bank)

- Mobile Banking & Payment Initiative of the Year - Vietnam

Mox Bank

- New Consumer Lending Product of the Year - Hong Kong

Nam A Bank

- Open Banking Initiative of the Year - Vietnam

- Risk Initiative of the Year - Vietnam

National Development Bank PLC

- Domestic Retail Bank of the Year - Sri Lanka

- Banking for Women Initiative of the Year - Sri Lanka

Nepal SBI Bank Limited

- SME Bank of the Year - Nepal

- Digital Business Banking Initiative of the Year - Nepal

NeuXP Service

- Innovation of the Year - Malaysia

OCBC Bank

- ASEAN SME Bank of the Year

OCBC NISP

- SME Bank of the Year - Indonesia

OCBC Securities

- Customer Service Initiative Award - Singapore

Oman Arab Bank

- Domestic Retail Bank of the Year - Oman

- SME Payment Solutions of the Year - Oman

Oriental Bank

- Start-up Banking Initiative of the Year - Cambodia

Pera Hub

- Fintech Digital Innovation of the Year - Philippines

PrimeCredit Limited

- Finance Company of the Year - Hong Kong

PT Bank CIMB Niaga Tbk

- Banking for Women Initiative of the Year - Indonesia

- Digital Consumer Banking Initiative of the Year - Indonesia

PT Bank CTBC Indonesia

- Consumer Finance Product of the Year - Indonesia

PT Bank HSBC Indonesia

- ESG Program of the Year - Silver

- Digital Business Banking Initiative of the Year- Indonesia

PT Bank Mandiri (Persero) Tbk

- Mobile Banking & Payment Initiative of the Year - Indonesia

- New Consumer Lending Product of the Year - Indonesia

PT Bank Tabungan Negara (Persero) Tbk

- Wealth Management Platform of the Year - Indonesia

KoinWorks

- SME Financial Inclusion Initiative of the Year - Indonesia

RAK Bank

- Mortgage and Home Loan Product of the Year - UAE

- Fraud Initiative of the Year - UAE

RAKislamic

- Islamic Banking Initiative of the Year - UAE

Rizal Commercial Banking Corporation

- Remittance Company of the Year - Philippines

- SME Bank of the Year - Philippines

- Marketing & Brand Initiative of the Year - Philippines

RCBC Bankard Services Corporation

- Credit Card Initiative of the Year - Philippines

RHB Banking Group

- Domestic Retail Bank of the Year - Malaysia

- Millennial Product Initiative of the Year - Malaysia

Sacombank

- SME Digital Innovation of the Year - Vietnam

Saigon-Hanoi Commercial Joint Stock Bank

- Strategic Partnership of the Year - Vietnam

- Banking for Women Initiative of the Year - Vietnam

SATHAPANA Limited

- Finance Company of the Year - Myanmar

Security Bank Corporation

- New Consumer Lending Product of the Year - Philippines

Shwe Rural and Urban Development Bank Ltd.

- Service Innovation of the Year - Myanmar

Social Islami Bank Limited

- Financial Inclusion Initiative of the Year - Bangladesh

Standard Chartered Bank (Taiwan) Limited

- International Retail Bank of the Year - Taiwan

- Digital Consumer Banking Initiative of the Year - Taiwan

- Investment Product Innovation of the Year - Taiwan

Standard Chartered Bank (Singapore) Limited

- International Retail Bank of the Year - Singapore

- Online Securities Platform of the Year - Singapore

- Structured Products Platform of the Year - Hong Kong

- Wealth Management Platform of the Year - Singapore

- Investment Product Innovation of the Year - Singapore

- New Consumer Lending Product of the Year - Singapore

Standard Chartered Securities (B) Sdn Bhd

- Wealth Management Platform of the Year - Brunei

Standard Chartered Bank (Hong Kong) Limited

- ESG Program of the Year - Gold

- Standard Chartered Bank (Hong Kong) Limited

- International Retail Bank of the Year - Hong Kong

- Employer Award of the Year - Gold

Statrys

- SME Payment Solutions of the Year - Hong Kong

Syfe

- Wealth Management Fintech of the Year - Singapore

Taishin International Bank

- Financial Inclusion Initiative of the Year - Taiwan

- New Consumer Lending Product of the Year - Taiwan

Techcombank

- Domestic Retail Bank of the Year - Vietnam

- External Social Initiative of the Year - Vietnam

- SME Payment Solutions of the Year - Vietnam

The Bank of East Asia, Limited

- Domestic Retail Bank of the Year - Hong Kong

- Digital Consumer Banking Initiative of the Year - Hong Kong

Thunes

- Payment Infrastructure Platform of the Year - Singapore

TNEX

- Virtual Bank of the Year - Vietnam

- Consumer Finance Product of the Year - Vietnam

Trust Bank Singapore

- Virtual Bank of the Year - Singapore

- Digital Consumer Banking Initiative of the Year - Singapore

Ujjivan Small Finance Bank

- Financial Inclusion Initiative of the Year - India

Union Bank of the Philippines

- Branch Innovation of the Year - Bronze

- Domestic Retail Bank of the Year - Philippines

- Digital Business Banking Initiative of the Year - Philippines

- Digital Transformation of the Year - Philippines

- Mobile Banking & Payment Initiative of the Year - Philippines

United Bank Limited

- Mobile Banking & Payment Initiative of the Year - Pakistan

UNO Digital Bank

- Open Banking Initiative of the Year - Philippines

United Overseas Bank Limited

- Domestic Retail Bank of the Year - Singapore

- Banking for Women Initiative of the Year - Singapore

- Debit Card Initiative of the Year - Singapore

- Fraud Initiative of the Year - Singapore

- Health and Wellness Initiative of the Year - Singapore

- Analytics Initiative of the Year - Singapore

- Mobile Banking & Payment Initiative of the Year - Singapore

UOB Malaysia

- International Retail Bank of the Year - Malaysia

UOB Thailand

- Employer Award of the Year - Silver

- International Retail Bank of the Year - Thailand

Vietcombank Remittance Company

- Remittance Company of the Year - Vietnam

PVcomBank

- Marketing & Brand Initiative of the Year - Vietnam

- Digital Transformation of the Year - Vietnam

Vietnam Technological and Commercial Joint Stock Bank

- Digital Consumer Banking Initiative of the Year - Vietnam

WeLab Bank

- Virtual Bank of the Year - Hong Kong

Yuanta Commercial Bank

- Open Banking Initiative of the Year - Taiwan

ZA Bank

- Debit Card Initiative of the Year - Hong Kong

- Domestic Retail Bank of the Year - Cambodia

AFFIN BANK BERHAD

- Financial Inclusion Initiative of the Year - Malaysia

- Digital Transformation of the Year - Malaysia

- Website of the Year - Malaysia

Airtel Payments Bank

- Virtual Bank of the Year - India

AmBank (M) Berhad

- Analytics Initiative of the Year - Malaysia

- Digital Business Banking Initiative of the Year - Malaysia

Ardshinbank

- Domestic Retail Bank of the Year - Armenia

Aspire FT Pte Ltd

- Digital Business Banking Initiative of the Year - Singapore

- Start-up Banking Initiative of the Year - Singapore

Hugosave (Atlas Consolidated Pte Ltd)

- Debit Card Initiative of the Year - Singapore

au Jibun Bank Corporation

- Strategic Partnership of the Year - Japan

AU Small Finance Bank

- Digital Consumer Banking Initiative of the Year - India

- Financial Inclusion Initiative of the Year - India

Axis Bank Limited

- AI & Machine Learning Initiative of the Year - India

Baiduri Bank

- Domestic Retail Bank of the Year - Brunei

Baiduri Finance

- Finance Company of the Year - Brunei

Bank BRI

- Financial Inclusion Initiative of the Year - Indonesia

Bank Dhofar

- Digital Transformation of the Year - Oman

BANK FOR INVESTMENT AND DEVELOPMENT OF VIETNAM

- SME Bank of the Year - Vietnam

Bank of China (Hong Kong) Limited

- Digital Transformation of the Year - Hong Kong

- Mobile Banking & Payment Initiative of the Year - Hong Kong

Bank of East Asia, Ltd

- Domestic Retail Bank of the Year - Hong Kong

Bank Rakyat Indonesia

- Mobile Banking & Payment Initiative of the Year - Indonesia

- COVID Management Initiative of the Year - Taiwan

- Financial Inclusion Initiative of the Year - Taiwan

- Service Innovation of the Year - Taiwan

BDO Network Bank, Inc.

- Marketing & Brand Initiative of the Year - Philippines

- Wealth Management Platform of the Year - Philippines

- Financial Inclusion Initiative of the Year - Philippines

- Investment Product Innovation of the Year - Philippines

Cake Bank and Mambu

- Core Banking System Initiative of the Year - Vietnam

Cathay United Bank

- Digital Consumer Banking Initiative of the Year - Taiwan

- Marketing & Brand Initiative of the Year - Taiwan

CB Bank

- SME Bank of the Year - Myanmar

Cebuana Lhuillier Rural Bank, Inc.

- Rural/Cooperative Bank of the Year - Philippines

Chang Hwa Commercial Bank

- Banking for Women Initiative of the Year - Taiwan

China Banking Corporation

- Digital Business Banking Initiative of the Year - Philippines

CIMB Thai Bank Public Company Limited

- Investment Product Innovation of the Year - Thailand

- Wealth Management Platform of the Year - Thailand

Commercial Bank of Ceylon PLC

- COVID Management Initiative of the Year - Sri Lanka

- Digital Wallet Initiative of the Year - Sri Lanka

CTBC Bank

- Domestic Retail Bank of the Year - Taiwan

- Branch Innovation of the Year - Bronze

DBS Bank

- Core Banking System Initiative of the Year - Hong Kong

- COVID Management Initiative of the Year - Hong Kong

DBS Indonesia

- Digital Business Banking Initiative of the Year - Indonesia

- Credit Card Initiative of the Year - Indonesia

- Digital Consumer Banking Initiative of the Year - Indonesia

DBS Taiwan

- Employer Award of the Year - Bronze

Equitas Small Finance Bank

- Marketing & Brand Initiative of the Year - India

Fidelity International

- Retirement Solutions of the Year - Hong Kong

- Service Innovation of the Year - Hong Kong

FINCA

- Banking for Women Initiative of the Year - Pakistan

Hana Bank

- Digital Consumer Banking Initiative of the Year - South Korea

Helicap

- Financial Inclusion Initiative of the Year - Singapore

Habib Bank Limited

- Point-of-Sale Initiative of the Year - Pakistan

HH Bank Cambodia

- Marketing & Brand Initiative of the Year - Cambodia

Hong Leong Bank

- SME Bank of the Year - Malaysia

Hong Leong Finance

- ASEAN Finance Company of the Year

HSBC

- Digital Consumer Banking Initiative of the Year - Hong Kong

- Wealth Management Platform of the Year - Hong Kong

PayMe

- Digital Wallet Initiative of the Year - Hong Kong

HSBC Bangladesh

- International Retail Bank of the Year - Bangladesh

- Branch Innovation of the Year - Silver

HSBC Bank (China) Company Limited

- International Retail Bank of the Year - China

- Marketing & Brand Initiative of the Year - China

HSBC Bank (Vietnam) Ltd.

- International Retail Bank of the Year - Vietnam

HSBC Indonesia

- Wealth Management Platform of the Year - Indonesia

- ESG Program of the Year - Bronze

- Marketing & Brand Initiative of the Year - Indonesia

HSBC Philippines

- International Retail Bank of the Year - Philippines

- Credit Card Initiative of the Year - Philippines

HSBC Bank (Singapore) Limited

- Remittance Company of the Year - Singapore

- Strategic Partnership of the Year - Singapore

HSBC Sri Lanka

- International Retail Bank of the Year - Sri Lanka

HSBC Taiwan

- Wealth Management Platform of the Year - Taiwan

- Credit Card Initiative of the Year - Taiwan

ICICI Bank

- Digital Transformation of the Year - India

- Service Innovation of the Year - India

Jordan Kuwait Bank

- AI & Machine Learning Initiative of the Year - Jordan

JS Bank

- SME Bank of the Year - Pakistan

KASIKORN LINE Co., Ltd.

- Financial Inclusion Initiative of the Year - Thailand

- New Consumer Lending Product of the Year - Thailand

KASIKORNBANK PCL.

- Mobile Banking & Payment Initiative of the Year - Thailand

- Strategic Partnership of the Year - Thailand

Krungthai Card

- Analytics Initiative of the Year - Thailand

LexinFintech

- Digital Business Banking Initiative of the Year - China

Maisarah Islamic Banking Services

- Islamic Banking Initiative of the Year - Oman

Malayan Banking Berhad

- Mobile Banking & Payment Initiative of the Year - Malaysia

- Online Banking Initiative of the Year - Malaysia

Mashreq Bank

- Digital Consumer Banking Initiative of the Year - UAE

- Digital Transformation of the Year - UAE

Maybank (Cambodia) Plc.

- International Retail Bank of the Year - Cambodia

Equity and Commodity Derivatives

Maybank Investment Bank Berhad

- Investment Product Innovation of the Year - Malaysia

Maybank Singapore

- Credit Card Initiative of the Year - Singapore

Maybank Indonesia

- Service Innovation of the Year - Indonesia

Mobilink Microfinance Bank Limited (MMBL)

- Digital Consumer Banking Initiative of the Year - Pakistan

Mox Bank

- Virtual Bank of the Year - Hong Kong

- Credit Card Initiative of the Year - Hong Kong

National Bank of Kuwait

- SME Bank of the Year - Kuwait

- Digital Consumer Banking Initiative of the Year - Kuwait

- Marketing & Brand Initiative of the Year - Kuwait

National Development Bank PLC

- Domestic Retail Bank of the Year - Sri Lanka

- SME Bank of the Year - Sri Lanka

Ngern Tid Lor Public Company Limited

- Finance Company of the Year - Thailand

- Insurance Product Innovation of the Year - Thailand

OCBC Bank

- ASEAN SME Bank of the Year

- SME Bank of the Year - Indonesia

OCBC Securities Private Limited

- Investment Product Innovation of the Year - Singapore

PrimeCredit Limited

- Finance Company of the Year - Hong Kong

PT Bank CTBC Indonesia

- Consumer Finance Product of the Year - Indonesia

- New Consumer Lending Product of the Year - Indonesia

PT Bank Danamon Indonesia, Tbk (Danamon)

- Open Banking Initiative of the Year - Indonesia

- Strategic Partnership of the Year - Indonesia

PT Bank Mandiri (Persero) Tbk.

- Domestic Retail Bank of the Year - Indonesia

PT Bank Permata, Tbk

- Millennial Product Initiative of the Year - Indonesia

Public Bank

- Domestic Retail Bank of the Year - Malaysia

RAKBANK

- SME Bank of the Year - UAE

- Fraud Initiative of the Year - UAE

- Mid-sized Domestic Retail Bank of the Year - UAE

RCBC Bankard Services Corporation

- New Consumer Lending Product of the Year - Philippines

Rizal Commercial Banking Corporation (RCBC)

- Remittance Company of the Year - Philippines

Rizal Commercial Banking Corporation (RCBC) and GBG

- AI & Machine Learning Initiative of the Year - Philippines

- Fraud Initiative of the Year - Philippines

Saigon Thuong Tin Commercial Joint Stock Bank (Sacombank)

- Digital Business Banking Initiative of the Year - Vietnam

Saigon-Hanoi Commercial Joint Stock Bank

- Digital Consumer Banking Initiative of the Year - Vietnam

- Millennial Product Initiative of the Year - Vietnam

SAS Institute

- Analytics Initiative of the Year - Singapore

- Analytics Initiative of the Year - Thailand

Sathapana Bank Plc.

- Mobile Banking & Payment Initiative of the Year - Cambodia

Siam Commercial Bank

- Domestic Retail Bank of the Year - Thailand

- Debit Card Initiative of the Year - Thailand

- Digital Business Banking Initiative of the Year - Thailand

SquidPay Technology Inc

- Digital Wallet Initiative of the Year - Philippines

Standard Chartered Bank

- Strategic Partnership of the Year - Malaysia

Standard Chartered Bank Capital Markets Products and Solutions

- Online Securities Platform of the Year - Hong Kong

- Wealth Management Platform of the Year - China

Standard Chartered Bank

- Digital Transformation of the Year - Singapore

Standard Chartered Bank

- Islamic Banking Initiative of the Year - Bangladesh

Standard Chartered Bank (Hong Kong) Limited

- Employer Award of the Year - Silver

- ESG Program of the Year - Gold

- International Retail Bank of the Year - Hong Kong

Standard Chartered Taiwan

- International Retail Bank of the Year - Taiwan

- Analytics Initiative of the Year - Taiwan

- Digital Business Banking Initiative of the Year - Taiwan

Syfe

- Wealth Management Fintech of the Year - Singapore

Taishin International Bank

- Mobile Banking & Payment Initiative of the Year - Taiwan

- Online Banking Initiative of the Year - Taiwan

- Strategic Partnership of the Year - Taiwan

- Credit Card Initiative of the Year - Vietnam

- Domestic Retail Bank of the Year - Vietnam

The Social Loan Company (TSLC)

- AI & Machine Learning Initiative of the Year - UAE

- Financial Inclusion Initiative of the Year - UAE

TNEX

- Virtual Bank of the Year - Vietnam

U Microfinance Bank Limited

- Microfinance Bank of the Year - Pakistan

- Islamic Banking Initiative of the Year - Pakistan

uab bank Limited

- Mid-sized Domestic Retail Bank of the Year - Myanmar

- Strategic Partnership of the Year - Myanmar

UBX Philippines

- Mobile Banking & Payment Initiative of the Year - Philippines

Union Bank of the Philippines

- Domestic Retail Bank of the Year - Philippines

- SME Bank of the Year - Philippines

United Bank Limited

- Mobile Banking & Payment Initiative of the Year - Pakistan

- Banking for Women Initiative of the Year - Singapore

- Domestic Retail Bank of the Year - Singapore

- ESG Program of the Year - Silver

- Mobile Banking & Payment Initiative of the Year - Singapore

- Wealth Management Platform of the Year - Singapore

United Overseas Bank (Malaysia) Bhd

- International Retail Bank of the Year - Malaysia

UOB Thailand

- Branch Innovation of the Year - Gold

- International Retail Bank of the Year - Thailand

- Employer Award of the Year - Gold

Viet Capital Commercial Joint Stock Bank

- Mobile Banking & Payment Initiative of the Year - Vietnam

Vietcombank Remittance Company

- Remittance Company of the Year - Vietnam

Vietnam Public Joint Stock Commercial Bank (PVcomBank)

- Digital Transformation of the Year - Vietnam

WeLab Bank

- Consumer Finance Product of the Year - Hong Kong

- Marketing & Brand Initiative of the Year - Hong Kong

ABA Bank

- Domestic Retail Bank of the Year - Cambodia

Affin Bank Berhad

- Initiative of the Year - Malaysia

- Start-up Banking Initiative of the Year - Malaysia

- Millennial product Initiative of the Year - Malaysia

Ahli Bank S.A.O.G.

- Domestic Retail Bank of the Year - Oman

Al Rajhi Bank

- Digital Banking Initiative of the Year - Saudi Arabia

- Mobile Banking & Payment Initiative of the Year - Saudi Arabia

Albaraka Islamic Bank

- Marketing & Brand Initiative of the Year - Bahrain

Alliance Bank

- Financial Inclusion Initiative of the Year - Malaysia

- Mobile Banking & Payment Initiative of the Year - Malaysia

- Service Innovation of the Year - Malaysia

AmBank Group

- SME Bank of the Year - Malaysia

Ardshinbank CJSC

- Domestic Retail Bank of the Year - Armenia

Aspire

- Fintech Startup of the Year - Singapore

Asakabank

- Domestic Retail Bank of the Year - Uzbekistan

au Jibun Bank Corporation

- Wealth Management Platform of the Year - Japan