Looking into Mox Bank’s rise as Hong Kong digital banking powerhouse

The digital bank was recognised as the Digital Bank of the Year - Hong Kong at the Asian Banking & Finance Retail Banking Awards 2025.

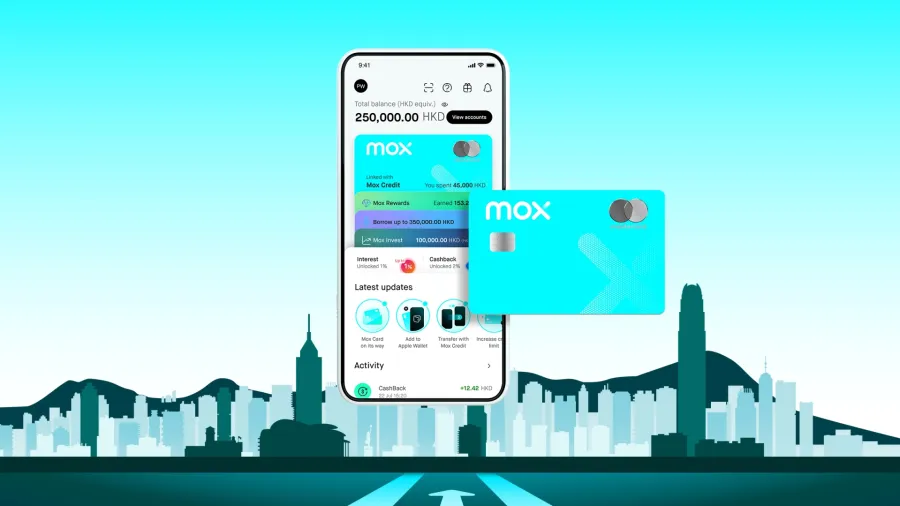

Mox Bank, a digital bank backed by Standard Chartered along with PCCW, HKT, and Trip.com, is redefining digital banking in Hong Kong through a smart, customer-first financial ecosystem. It stands at the forefront of transformation, challenging traditional financial paradigms and setting new industry benchmarks.

Within five years of its inception, Mox Bank has grown to over 650,000 customers, capturing more than 10% of Hong Kong’s bankable population, with HK$17b in deposits and HK$6b in loans as of 2024. Its innovative approach and rapid growth earned it over 120 accolades from organisations around the world over the years.

Moreover, the digital bank continues to transform challenges into opportunities through advanced data-driven risk intelligence, a scalable tech stack now powering Singapore’s Trust Bank, and seamless customer experiences.

Its product innovation includes the first U.S. and Hong Kong equities trading by a digital bank in the city, the first bank in Hong Kong to launch U.S. fractional share trading. Its crypto ETF opens the door for retail investors to be exposed to cryptocurrencies under a regulated environment; the instant FX remittance services expanded to 13 countries, and the acclaimed “Core Portfolio” service provides retail investors access to personalised and portfolio-based advisory services. It also includes a partnership with Cathay on Asia Miles rewards campaign that gives customers the choice to earn Asia Miles as rewards for time deposit and Mox Credit Card spending. Mox Credit also offers CashBack in real cash, credited directly to customers’ savings accounts.

More than just a banking platform, Mox Bank is a forward-thinking financial partner reshaping the future of banking through innovation, inclusion, and a relentless focus on customer needs, built on trust. This exceptional approach has been lauded by the Asian Banking & Finance Retail Banking Asia Awards 2025, where the digital bank was honoured as the Digital Bank of the Year - Hong Kong.

Speaking with Asian Banking & Finance, the bank reflects on its success and how it continues to maintain its momentum through continuous customer feedback, agile teams and a people-driven culture that brings its digital banking vision to life.

Mox has captured over 10% of Hong Kong’s bankable population in just five years. What do you believe was the most important driver behind this rapid market penetration?

Our strong market penetration, capturing over 10% of Hong Kong’s bankable population in just five years, stems from a multifaceted approach. Primarily, our unwavering commitment to a customer-centric digital experience, rooted in trust, drives this success. We prioritised a seamless, mobile-first experience, offering intuitive interfaces, instant account opening, and real-time financial tools meticulously tailored to modern consumer expectations.

Equally critical, our strategic partnerships unlocked significant growth. By leveraging the robust ecosystems of our esteemed founding partners — Standard Chartered, HKT, PCCW, and Trip.com — Mox gained unparalleled access to a wide customer base, exclusive offers, and powerful cross-industry synergies. This symbiotic relationship propelled our reach and delivered unique value propositions.

Furthermore, our agility and data-driven campaigns significantly accelerated our progress. Mox embraced agile methodologies and a cloud-native infrastructure, enabling us to rapidly roll out innovative features and respond to user feedback with unprecedented speed compared to traditional banks. A prime example of this success is the “Asia Miles rewards campaign,” which resonated profoundly with higher-earning customers, significantly boosting both customer acquisition and engagement.

In 2024, one of the key drivers of Mox's improved financial performance has been its success in attracting customers whose income is nearly double that of the local median monthly earnings. To cater to the spending habits of this segment, Mox launched the “Asia Miles rewards campaign” that allowed our customers to earn 1 Asia Mile as rewards for every HK$4 spent with Mox Credit Card with zero cap on Asia Miles as rewards and enjoy 0% FX fees on any spending transactions made overseas or online.

The successful “Asia Miles rewards campaign” significantly accelerated the acquisition of these quality customers, who represented almost 30% of Mox's customer base and are becoming a new growth driver. This targeted approach resulted in increased engagement with Mox’s products and services, boosting product penetration and overall business growth. Their impact includes significantly higher spending power (their spending was 3x on average) and deposit amounts (maintained 3x deposits on average).

Mox is known for turning technological disruption into opportunity. What’s one standout innovation that you think truly set Mox apart?

Mox leverages a data and technology first approach, using artificial intelligence across the customer lifecycle to improve customer outcomes. For customer service, we apply natural language processing to automate proactive support, setting industry standards in customer experience.

The success story of Mox as Hong Kong’s leading digital bank has been its ability to address the challenges, inefficiencies and limitations of traditional banking by finding new and innovative technology solutions. Mox is not simply a layer of technology built upon foundations of traditional banking but has been built from the ground up as a Fintech startup.

Our objective is to reimagine banking, not only to allow our customers access to enhanced financial products and services, but to help them become more engaged, making it safer, smarter, faster and easier for them to manage and plan for their financial goals, delivering all this through the Mox mobile app installed on their handheld mobile devices.

Whilst Mox consistently transforms technological disruption into tangible opportunities, Mox Invest truly stands out as a groundbreaking innovation that has undeniably set us apart. It redefines the investment landscape by offering fractional U.S. stock trading, cutting-edge crypto ETFs, and highly competitive mid-market FX rates, which have consistently generated strong trading volumes.

Moreover, Mox became the first and the only digital bank in Hong Kong to offer Asia Miles as part of our core value proposition (CVP). The integration of Asia Miles into its CVP also merits significant recognition with a distribution of over 1 billion Asia Miles to customers as rewards. This innovative integration created immense value and fostered deep customer loyalty.

Finally, our relentless focus on seamless UI/UX design underpins everything we do. Mox's mobile-first design philosophy culminates in an incredibly clean, intuitive, and highly responsive app experience, ensuring every interaction proves effortless and engaging.

How is Mox Bank making wealth creation more accessible for the average customer?

Mox Bank fundamentally democratises wealth creation, making it accessible to a broader spectrum of customers. Mox Invest leads this mission. By offering low-entry-point investments, such as investing in funds with as little as HK$1 and low fees, access to crypto ETFs, and a straightforward U.S. and Hong Kong stock and U.S. fractional share trading service, Mox is breaking down traditional entry barriers and empowering more individuals to seize investment opportunities.

A key differentiator significantly enhancing returns for our customers is our provision of mid-market FX rates. This remains a rare offering for retail customers, directly translating to more transparent and fair exchange rates and ultimately enhancing their investment returns.

Furthermore, our smart saving and smart borrowing tools prove integral to fostering financial health and supporting long-term wealth building for our customers. These intelligent tools provide practical guidance and mechanisms to help customers manage their finances effectively and build a secure financial future.

Congratulations on being named Digital Bank of the Year – Hong Kong. How do you maintain innovation momentum whilst scaling responsibly?

We are immensely proud to be named Digital Bank of the Year – Hong Kong. Maintaining our innovation momentum whilst scaling responsibly forms a core tenet of our operations.

Our agile development approach proves fundamental to achieving this balance. With our north star of making banking safe, simple, smart and fun, Mox embraces a visionary mindset, leveraging cutting-edge methodologies and agile, dedicated teams to drive innovation. This structure facilitates rapid experimentation, swift iteration, and the continuous delivery of new features that consistently meet our customers' evolving needs. Our robust security measures foster trust, giving our customers confidence in our ability to safeguard their assets.

Customer feedback loops drive the heart of our innovation cycle. We meticulously place customer feedback at the core of our product design and development. The bank closely monitors product engagement, as shown by an impressive average of 15 logins per active user per month. This data also provides invaluable insights that directly inform our product roadmap and development priorities.

Lastly, our innovation is only made possible because of our human talents. The Moxsters (the name we called our employees) are instrumental in driving digital innovation that addresses customers’ needs. They are the interface between our technology and ambitions and our customers, and it is this that makes our vision of reimagining banking possible.

The ABF Retail Banking Awards is presented by Asian Banking & Finance Magazine. To view the full list of winners, click here. If you want to join the 2026 awards programme and be recognised for your company's cutting-edge products, services, and solutions that made a positive impact on your customers, please contact Julie Anne Nuñez-Difuntorum at [email protected].

Advertise

Advertise