Chart of the Week: These 3 Chinese banks' shadow loan books exceed their official ones

Asset quality is feared to deteriorate further.

According to BMI Research, Chinese joint-stock, city and rural commercial banks have been growing their exposure to trust beneficiary rights and directional asset management plans at a fast rate, which we believe poses growing credit risks due to the lack of transparency and provisioning.

"Chinese regulators are aware of the financial instability risks stemming from a significant rise in shadow loan growth, as reflected by the release of Document 82 in April, and we believe that they will impose stricter rules if growth continues apace. Lastly, the premium valuations of medium-tier and smaller banks over that of big state-owned banks are not warranted due to their higher balance sheet risks."

Here's more from BMI Research:

As the mainland economy weakens over the coming years, we believe that JSBs and CCBs are most at risk from a deterioration in asset quality in TBRs and DAMPs due to their weaker capital position. Indeed, data from Yindeng (China's registration centre of credit assets for banks) showed that 86% of the total amount of registered credit asset transfers in 2015 was sold by city level banks and 13% were by jointly-owned banks.

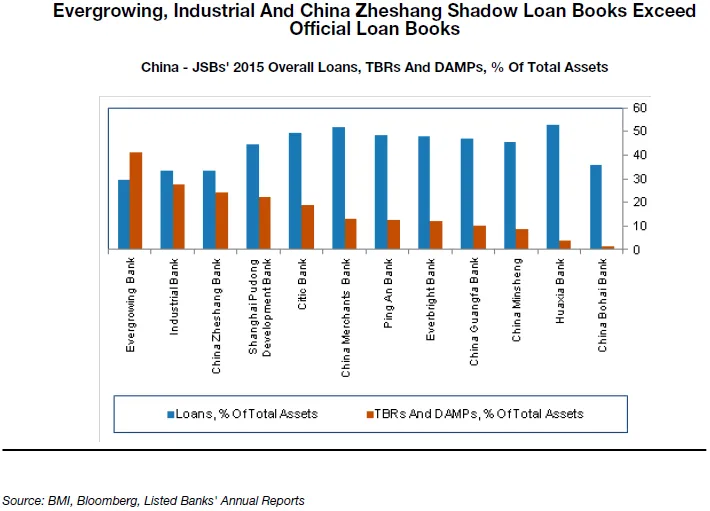

Notably, several banks are extremely vulnerable, as their shadow loan books are almost as large as their total loan books or, in some cases, even greater. Although the actual amount of provisioning by banks is not properly disclosed, it is likely that the amount of provisioning by these banks is insufficient. For JSBs, we highlight that Evergrowing Bank, Industrial Bank, and China Zheshang Bank are particularly exposed.

■ Evergrowing Bank: Evergrowing Bank has significant exposure to opaque investment receivables, in particular TBRs and DAMPs, and this poses significant downside risks for the unlisted bank. We highlight that its overall amount of TBRs and DAMPs as a share of total assets and loans is the highest among the 12 JSBs in China. As a proportion of total assets and loans, it stood at 41.2% and 138.9% in 2015, respectively (versus an average of 16.3% and 42.5% for all listed and unlisted JSBs). It also suffered from a shadow loan default in September 2014, which we discuss in greater detail below.

■ Industrial Bank And China Zheshang Bank: Industrial Bank and China Zheshang Bank's share of total TBRs and DAMPs to overall assets and loans are the highest within the listed JSB space (see chart above), and the lack of transparency on their shadow loan book warrants caution. The banks' shadow loan books grew at a rapid pace in 2015, clocking growth of 18.3% and 228.2%, respectively.

While their NPL provisioning ratios were higher than the average for JSBs, standing at 210.1% and 240.8%, respectively, in 2015, this is likely to continue declining as NPLs rise in line with risks from losses from investment receivables as defaults in China climb.

Advertise

Advertise