Economy

Singapore finance firms struggle as 72% face talent gap

Singapore finance firms struggle as 72% face talent gap

Survey shows 94% are revising financial and operational plans to secure workers.

Finance Ministry raises idle fund bank cap to 60%

After that, the funds will remain in banks until maturity.

Retail banks complete rollout of Money Safe anti-scam service

Mandatory face-to-face verification adds new layer of deposit protection

HKMA launches IP financing sandbox for innovative SMEs

Sandbox aims to assist pilot sectors in leveraging IP assets

Malaysia’s central bank says FATF outcome supports financial system confidence

The upgrade reflects stronger compliance and effectiveness in tackling money laundering.

Tight credit conditions drive Asia-Pacific corporate insolvencies

Higher interest rates and weaker demand strain corporate balance sheets across the region.

Hong Kong banks race to hire AI-ready talent as skill gap widens

Software development will be the biggest talent shortfall by 2030.

Singapore vital in Southeast Asia’s digital economy: report

The city-state led in digital payments last year as the region’s economy is projected to reach $1.299t by 2030.

Philippine cybercrime cases triple as fintechs deploy AI to curb money mulling

Losses hit US$3.35m as regulators tighten controls.

Five takeaways from day 1 of the Singapore Fintech Festival

Tokenisation emerges as a key driver of future digital money systems.

Why finance leaders push tokenisation as next phase of digital money

Tokenised deposits invert the model, allowing banks to deliver liquidity directly where required.

Singapore builds a three-tier strategy to future-proof its workforce

The plan spans basic AI literacy to advanced development as technology reshapes jobs.

Singapore pursues digital economy ties with ASEAN and global blocs: DPM

DPM Gan also said Singapore is focusing especially on financial services to stay globally relevant.

Asia’s regulators need to match banks’ digital pace, GFTN says

Good regulation, he argued, should function as “a safety belt, not a brake."

Banks post record $1.2t profit in 2024: McKinsey

If banks fail to adapt AI, global profit pools could fall by about $170b.

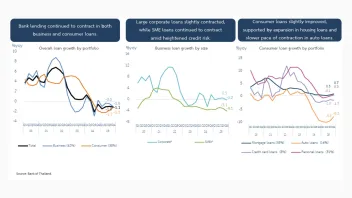

China’s banks expand lending but struggle with weakening demand

UOB Kay Hian said banks remain cautious in extending long-term credit.

Why Indian banks are seen to absorb loan losses

S&P also said earnings are likely to moderate but remain above long-term averages.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026