Lending & Credit

Filipinos outside capital favour loan apps and microloans over credit cards

Filipinos outside capital favour loan apps and microloans over credit cards

The majority expressed willingness to access educational materials to improve their finances.

1 day ago

Krungsri names Chayathip Phanmanee as head of Krungsri Auto Group

Phanmanee implemented debt restructuring policies during the COVID-19 period.

1 day ago

Indian banks’ deposits and loans log double digit growth on sustained demand

Banks continued to see demand for auto loans and MSME loans.

2 days ago

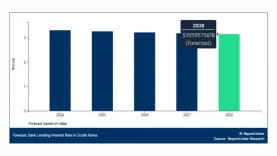

South Korea lending rate to fall to 3.16% by 2028

Borrowing costs will extend their downward trend after a 21% drop in 2023.

4 days ago

Philippine cash remittances hit record $3.52b in December

Full-year inflows and personal remittances both hit an all-time high.

4 days ago

CBA credit losses seen steady as debt risks linger: S&P

The bank is vulnerable to housing-related risks.

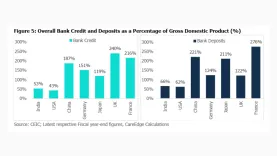

How India’s 53% credit-to-GDP ratio exposes a lending gap

Formal borrowing is expanding but still trails the scale of domestic economic activity.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Customers now expect visibility alongside instant credit experiences.

How can Indian lenders balance loan growth and risk?

Reforms could help improve efficiency, especially of state banks.

Taiwan SME loans jump $17.38b in 2025 as banks hit 120% target

SME loans made up 64.81% of total loans extended to all enterprises.

Big borrower default could wipe out a year of SEA bank earnings: S&P

Brunei, the Philippines, and Thailand are the most exposed to loan concertation risk.

Indian bank credit jumps 14.4% in December as gold loans double

Power segment and ports drive infrastructure credit growth.

Westpac hikes home loan rates as it flags budget pressure

Westpac's consumer chief executive recognized that the increase may add pressure to households.

Norinchukin fortifies JA Mitsui Leasing after $968m fraud allowance

Norinchukin is in talks with SMBC and other major banks to provide loans to JAML.

SMBC signs SBI pact to back India sunrise sector project finance

They aim to grow India’s “sunrise sectors”.

Vietnam banks face whiplash as fast lending fuels asset price risks

Credit growth target is 15% in 2026, but banks can be hurt if prices correct.

Malaysia credit growth eases to 5.3% as business loans cool

The banking system’s liquidity coverage ratio rose to 154.8% during the month.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership