Financial Technology

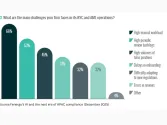

Cybercriminals exploit identities across APAC finance

Cybercriminals exploit identities across APAC finance

Deepfakes, phishing and stolen credentials are driving banks to overhaul authentication.

3 days ago

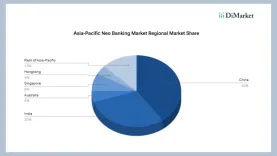

APAC neobanking hits $261b in 2025 as mobile use rises

China and India account for 70% of regional market share.

4 days ago

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

HSB collects ground-level fraud signals that are captured in standardised entries.

6 days ago

Korea revises bill to check criminal info of virtual asset service providers

The law also broadened rule-breaking activities that are screened.

6 days ago

UnionPay links 25 foreign wallets to Weixin Pay as China QR use surges

Global travellers can use domestic cards on Weixin Pay QR network

BPS Financial fined $9.67m over Qoin Wallet crypto promotion

It is also hit with a 10-year ban for making unlicensed services.

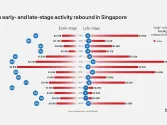

GFTN targets growth-stage fintechs with $200m fund

The focus will be on firms that have shown commercial traction and scale.

Citi, CredAble partner for digitalised invoices, trade finance controls

The platform can validate invoices by verifying over critical fields such as values, dates, amongst others.

This week in finance: TenPay Global CEO on interoperable payments; tap-to-pay service roll-outs

OCBC and Vietnam separately strengthen their QR payment ties with China.

Tencent’s TenPay Global opens WeChat mini programs to overseas wallets

Visitors from other countries may now use their homegrown wallets inside Mainland China.

SFF shifts focus toward global fintech impact

GFTN outlines shift from scale to real-world outcomes.

Deepfakes expose major weaknesses in mobile banking security

AI-driven fraud is outpacing banks’ current protections.

AI-driven deepfakes expose banking security gaps

AI-generated attacks are accelerating faster than banks’ ability to secure.

Vietnam, Ant International partner for fintech push in Ho Chi Minh City

This aims to guide the city on fintech regulations and provide platforms for SMEs.

Tokyo positions fintech startups for global expansion

Japan’s advancing regulatory environment is creating major opportunities for global fintechs.

Tokenisation transforms liquidity management for global banks

Broadridge’s Distributed Ledger Repo platform accelerates collateral velocity and cuts clearing fees.

Advertise

Advertise

Commentary

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership