Investment Banking

Which banking roles in Hong Kong earn the highest annually?

Which banking roles in Hong Kong earn the highest annually?

Managing directors in IPO and M&A roles get the highest annual salary.

29 minutes ago

How will Hong Kong banks handle talent shortage and tight budgets?

Investment analysts and compliance specialists remain most sought after.

14 hours ago

Societe Generale name Selina Cheung as head of ECM in APAC

Cheung was previously head of unified global banking APAC at UBS.

20 hours ago

Citi forms AI Infrastructure Banking team to tap $3t financing opportunity

The team aims to provide debt financing to fund data centres and other infra capacity.

4 days ago

DBS and TenPay Global launches zero-fee transfers to Weixin Pay wallets

The bank connects customers to mainland China wallets.

Chinese banks slash USD bond exposure to 85%

Banks are increasing bond investments in the Euro and likely the AUD, said BofA.

Korean regulators hit 5 banks with record $1.38b in ELS penalties

Kookmin Bank will face the highest penalty if based on sales amount, the report said.

APAC to capture $4t private credit boom as loan returns shrink

Australia, Japan, and India are emerging as key private credit growth markets.

Citi foresees more Asia M&A deals on healthcare and multinational moves

In 2026, Citi already led two M&A biopharma deals in China.

Trust is first banking app in Singapore to offer fractional trading

It now gives access to over 7,000 US stocks and ETFs.

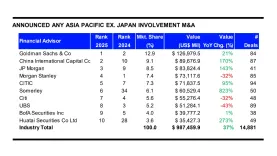

Goldman topped APAC M&A in 2025 as Morgan Stanley fell: LSEG

China International Capital Co. and Somerley got the most gains in 2025.

Deutsche Bank Malaysia appoints first female chair, new non-executive director

The appointees bring expertise in finance, audit, risk, governance, policy.

Bank of America's 2025 earnings jump 19% to $30.5b

Q4 net income rises 12% to $7.6b as the bank caps record year.

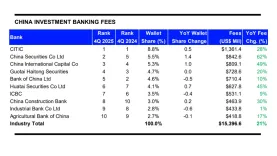

CITIC leads China investment banking fees as market hits 3-year high

It retained its position as the top financial institution in terms of IB fees raised.

Crédit Agricole CIB names Yang Zhang as head of cash and trade sales for APAC FIs

She will oversee business development and origination of cash management.

Citi hires NAB, CBA bankers for Australia syndication team

Jessica Rowe joins from NAB whilst Dane Harris joins from CBA.

How investment banks can raise transaction banking value by 50%

Partnering with fintechs or making front office changes can raise profit by 3%-10%.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision