Chart of the Week: Australia and Hong Kong banks hit by negative property sentiment

The decline in property prices may drive loan impairments up.

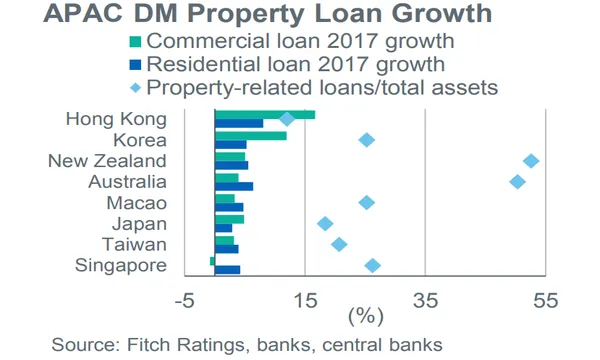

Souring sentiment in the property sector is expected to hit the Australia and Hong Kong banking systems hard, according to Fitch Ratings, as the real estate sector continues to pose a key risk for banks across Asia Pacific.

Also read: Home loans buoy Malaysian banks' growth prospects

The massive property exposure of Hong Kong banks to the weakening property sector has flagged dismal forecasts about its lending and profit figures.

“A significant and fast price decline in Hong Kong could hurt sentiment and expose imbalances as high and rising prices have boosted private-sector wealth, banks’ reserves and collateral valuations,” Fitch said in an earlier report.

New Zealand and Australia also have the greatest property-related loans and assets in APAC at nearly 55%, highlighting their vulnerability. Australia, in particular, has already witnessed slower credit growth in March as the heated property market lost steam on the back of tumbling prices.

Also read: Mortgage slowdown to hit Australian bank loans in 2019

"We expect loan impairments to rise, in light of current property prices, household leverage, rising interest rates, slower credit growth, and (now) slower GDP growth," the firm said in a report. However, Fitch Ratings notes that this is unlikely to be the case for Japan where sentiment should hold steady at least until 2020.

Advertise

Advertise