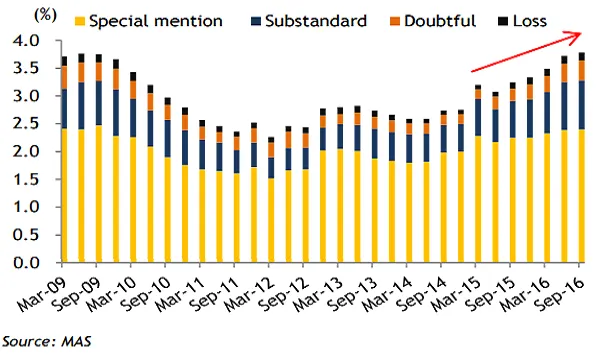

Chart of the Week: Singapore banks' classified exposure level at its worst since 2009

The banks' credit quality is still worsening.

According to Maybank Kim Eng, exposures to special mention, doubtful and loss categories have worsened to levels not seen since 3Q09. Sub-standard category is now at its highest level since disclosure started in 2009.

"Our credit costs estimate for Singapore banks is on average between 39-44bps for FY16-18E. For every 10bps decline in credit costs across Singapore banks, we estimate that FY17-18E net profits will increase by c.6-7%."

Advertise

Advertise