Thai banks bear the brunt of lower SME lending rates

TMB and KBANK are poised to suffer the most should they opt to accommodate SMEs.

Thailand banks are projected to bear the weight of lower lending rates but the negative effect is set to vary across companies depending on their exposure to SME loans, according to Maybank Kim Eng.

This comes as the finance minister Apisak Tantivorawong commented that the net interest margin of banks is too high and that lending rates should be slashed to help SMEs with their capital needs, prompting a 4.3% average decline in the stock prices of Thai banks last April 4.

“If banks eventually do cut lending rates, they are likely to do so only for SME loans, just as they did last May. Therefore, most impacted should be banks that have greater exposure to SME loans, such as TMB and KBANK,” the report noted.

Also read: Thai banks' loan growth could hit 6.7% in 2018

TMB stands to lose 6% in earnings whilst Kbank could emerge 5% poorer in terms of foregone revenue. Both KKP and SCB can lose 4% whilst SCB, BAY, TCAP, BBL are at 2% due to minimum SME loan exposure, Maybank Kim Eng estimated.

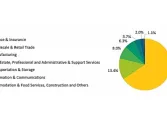

TISCO, on the other hand, is the most insulated from lower lending rates as it only stands to lose 1% of possible earnings in 2018 as three-quarters of its loans are fixed-rate retail loans.

Advertise

Advertise