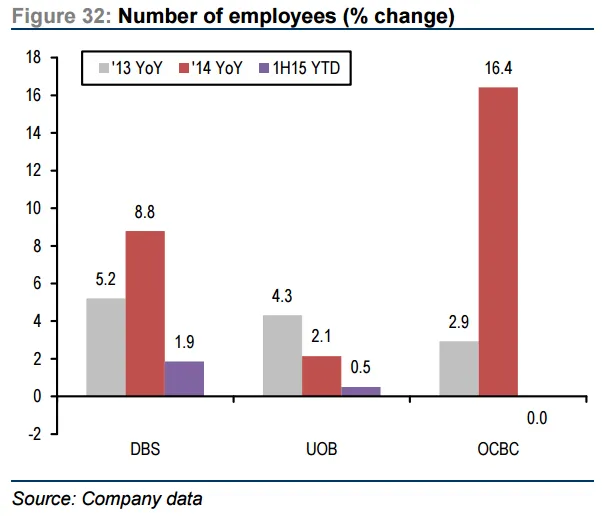

Which large Singaporean bank is not hiring at all this year?

Banks turn cautious as costs surge.

Singapore's largest banks have turned more disciplined and cautious when it comes to increasing their headcount, according to Credit Suisse.

This is on back of uncertain regional macroeconomic conditions and considerably higher staff costs.

This chart shows that DBS, UOB and OCBC all booked lacklustre employee growth in the first half of the year.

Headcount at DBS grew by 1.9% year-to-date, much lower that 8.8% for the whole of 2014. Meanwhile, UOB's headcount grew by a measly 0.5% YTD, compared to 2.1% in the entire 2014.

The number of employees at OCBC did not increase at all in the year so far.

"Cost pressure in general continues to be tight despite banks becoming much more disciplined on headcount. Higher bonus accruals and technology-related costs remain the key drivers of cost growth.Banks in general have become more disciplined on headcount as regional macro conditions remain uncertain. They seem to be selectively recruiting in specific business units like wealth management and technology," Credit Suisse said.

Advertise

Advertise