In Focus

Will reforms save South Korea’s mutual savings banks?

Will reforms save South Korea’s mutual savings banks?

Small-business and P2P lending offers fresh revenue streams.

2 hours ago

Dah Sing revamps banking platform for SMEs

It combines remote onboarding, business hubs, fee cuts, and an FX debit card.

10 hours ago

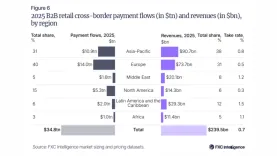

APAC leads B2B cross-border payments revenue share at 38%

The region’s share was equivalent to $90.7b. and was followed by Europe with $73.7b.

11 hours ago

BofA’s Winnie Chen charts real-time payment path

Companies want simplicity and certainty as they move funds across borders.

2 days ago

Yoonmee Jeong drives OCBC’s green finance push in Asia

The wager is that transition finance will expand even if the alliances around it do not.

3 days ago

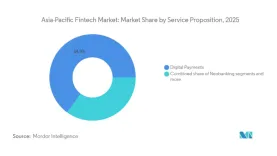

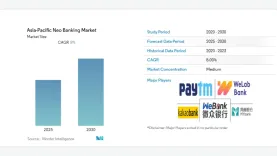

Neobanking to grow 30.46% CAGR in APAC

Fintech value projected to reach $348.1b by 2031 as online banking platforms expand.

3 days ago

HSBC sees Hong Kong driving global RMB adoption

Vina Cheung expects RMB to rise to the third most-used global payment currency.

4 days ago

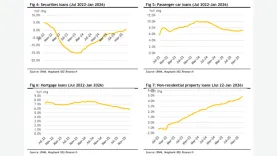

Hong Kong mortgage accounts up 3.6% in Q4 as lower rates trigger demand

Improved affordability might drive new mortgages or refinancing activity.

4 days ago

Malaysia's corporate lending slumps to 3.8% as 24-month credit gains unwind

Total credit, including bonds, still accelerated to 5.5% year on year by the end of January 2026.

4 days ago

Indonesian banks gain funding relief as deposits rise 16%

SOE banks recorded stronger loan growth compared to their peers.

5 days ago

Stablecoin payment volumes double to $390b as Asia claims 60% share

Majority of activity is in Singapore, Hong Kong, and Japan, according to McKinsey and Artemis Analytics.

5 days ago

APAC neo banks face trust barrier despite 8% CAGR

Mordor Intelligence sees expansion through 2030 even as rural access gaps slow uptake.

5 days ago

Which banking roles in Hong Kong earn the highest annually?

Managing directors in IPO and M&A roles get the highest annual salary.

6 days ago

India bank credit hits $2.4t amidst fintech boom

Formal banking reach expanded to 569.3 million Jan Dhan accounts by early November 2025.

6 days ago

How will Hong Kong banks handle talent shortage and tight budgets?

Investment analysts and compliance specialists remain most sought after.

Hong Kong banks ‘resilient’ despite falling CRE property values

Many banks have solid earnings and excess capital to absorb potential losses.

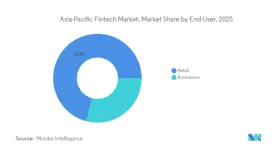

Retail holds 71% of APAC fintech market in 2025

Enterprise users to expand at 25.47% annually through 2031.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026