Digital players steal market share from traditional banks

Value migration and AI-driven changes pose challenges for financial institutions.

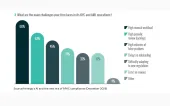

AI is making strides in the financial sector, and digital players are steadily eroding market share from traditional banks. Isaac Tan, Partner at Boston Consulting Group, identified value migration as a primary challenge for financial institutions.

“There’s certainly some headwinds facing the financial services industry,” Tan said. “Number one, we see value migration. An attacker, like the digital players, is stealing shares away from traditional banks.” He cited Brazil, where a digital-only bank, Nubank, now holds a larger market capitalization than all its traditional banking counterparts combined.

With new regulations, such as the "Basel IV" regulations set to take effect later this year, financial institutions will face stricter capital requirements. Tan noted, “It’s not looking good for banks’ profitability” as these regulatory changes, combined with the rise of digital competition, continue to reshape the industry landscape.

Another significant concern is geopolitical risk, which financial institutions must factor into their future strategies. As political and economic uncertainty continues to grow globally, banks need to carefully consider how these factors could impact their operations in the next decade.

While these challenges may seem daunting, Tan highlighted that the rapid advancement of AI “will truly become a game changer.”

“Imagine AI becoming conversational, allowing you to do conversational banking in space,” he said. Customers will soon be able to engage with their banking apps through natural language, making transactions and seeking financial advice with ease.

With AI poised to drive these shifts, workforce upskilling will become a critical issue for financial institutions. Tan explained, “It’s no longer a question of whether they need to do it. It’s a question of when and how they need to do it to ensure successful workforce transition.”

“To remain competitive,” Tan concluded, “financial institutions will need to focus on human elements, championing values like ethical banking, while embracing technological advancements like AI.”

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership