Financial services, insurance lose $2.2m per hour from outages: study

The value they lose is 16% higher than the average across all industries.

The financial services and the insurance industry collectively lose $2.2m per hour from outages and disruptions, according to a study by intelligence platform New Relic.

This is 16% higher than the average across all industries.

Companies from these sectors experience “high-business-impact” outages more often than most industries, the study found. Nearly half (48%) of respondents reported at least one such incident weekly.

“A $2.2m-per-hour impact shows just how quickly disruption can hit — especially for financial services and insurance companies operating in complex digital ecosystems,” said Simon Lee, SVP and managing director for New Relic’s Asia Pacific and Japan business.

Across APAC, firms are under growing pressure to modernise their observability strategies and move faster to prevent downtime before it impacts customers, Lee noted.

In response, businesses in these sectors are investing in digital-native subsidiaries and adopting technologies such as artificial intelligence (AI).

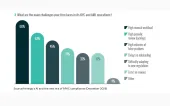

About 34% of respondents cited AI-assisted troubleshooting as crucial to improve observability, or to prevent downtimes.

Organizations in the financial services and insurance sectors are also ahead of other industries in cloud- native application development (36% adoption compared to 31% across all industries) and containerized workloads (28% versus 23% overall).

Advertise

Advertise