Chart of the Week: Check out the breakdown of Thai banks' bad loans

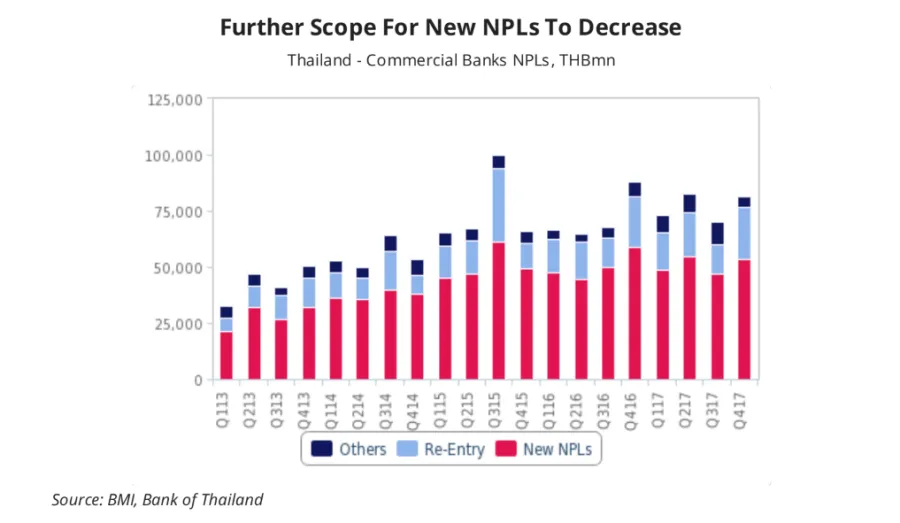

New NPL formation dropped to 66.4% of total bad loans in 2017.

An aggressive portfolio cleanup by Thai banks have shed a considerable amount of non-performing loans (NPLs) in recent years as NPL ratio clocked in at a stable 2.9% in Q1 which has stayed at that level since last year, according to BMI Research.

New NPL formation as a share of total stressed assets also dropped from 70% in 2016 to 66.4% in 2017 as it approaches the 65.9% level seen in 2013.

"Given that NPLs typically lag economic performance by 18-24 months, we believe that the rate of NPL formation will likely decrease in the coming quarters as the economic recovery that began in 2016 begins to feed through," BMI added.

Also read: How can Thai banks cushion the cost impact from waived digital fees?

Large institutional investors are mulling acquiring or establishing licensed platforms in preparation for future loan trades to shave off Thailand's bad loan problem, according to a report from Deloitte.

Also read: Thai banks' earnings fall 8% in Q4

More recently there have been a few small deals in the market including Apollo’s acquisition of CSG, Bain’s acquisition of Standard Chartered’s NPL business and SSG’s acquisition of a loan servicing platform from GE Capital.

Advertise

Advertise