CIMB Singapore raises deposit interest rate tenfold to up to 2% annually

StarSaver savings account holders can enjoy the new rate without any deposit caps.

CIMB Singapore is the latest bank in the Lion City to raise its interest rates for its deposit accounts.

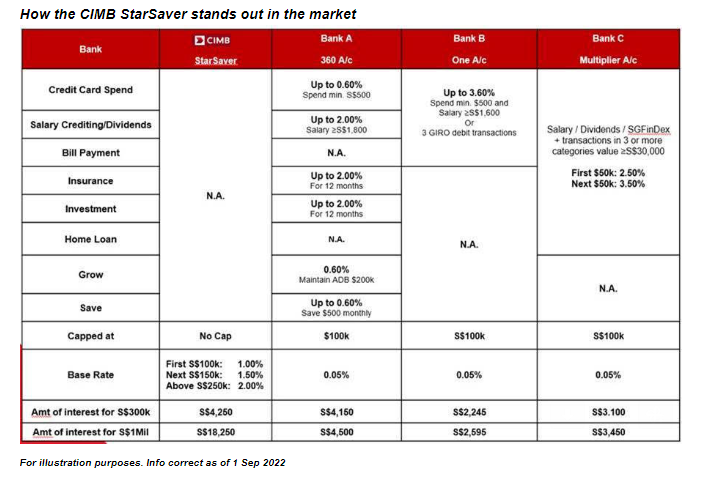

The bank is offering up to a 2% per annum interest for all its CIMB StarSaver savings accounts, with no deposit cap.

The first S$100,000 deposited will enjoy a 1% interest rate; the next S$150,000 will get 1.5%; and the next S$250,000 and above will get 2%.

This is ten times higher than the past interest rate, which was at 0.2%.

“There are no multiple conditions to fulfill to earn up to 2% p.a. interest rate. There is no need to do salary-crediting with us, have a minimum spend on your CIMB credit card or any of those prerequisites such as purchasing an insurance or investment product from us,” CEO Victor Lee bank said in the bank’s press announcement.

Advertise

Advertise