News

Singapore banks' full-year loan forecast still at 'modest' 0.3%: report

Singapore banks' full-year loan forecast still at 'modest' 0.3%: report

Whether the uptick can be sustained remains to be seen.

Bank Jago partners with Mambu to enhance digital banking services

The bank will use Mambu’s SaaS banking platform.

BRI Agro partners with Payfazz to offer digital banking solutions

Payfazz agents can now offer Pinang’s savings, lending solutions to their 10 million customers.

Bank of Korea to carry out mock test on functionality of digital currency: report

The test will reportedly start in August and run until June 2022.

Deutsche Bank appoints new regional treasurer for APAC

Ip first joined the bank’s London branch in 2004.

APAC banks face time bomb of risks amidst new climate change policies

Those who drag their feet when it comes to ESG compliance face a future of impairments, reputational damage.

Indonesia mulls digital rupiah: report

The central bank is looking at how it will help monetary policy goals.

HSBC exits US mass market retail banking, sells 90 branches

All personal, advance, and retail business banking customers with turnover below $5m are affected.

Deutsche Bank appoints new head of trade finance & lending in China

Daniel Qian is also head of structured trade & export finance.

Thailand’s KBank unveils sustainability fund for institutional clients

K-SUSTAIN-UI will invest in a sustainability-focused fund managed by JP Morgan.

Hong Kong’s Airstar Bank pilots corporate banking services for SMEs

The pilot trial is open to 100 small and medium enterprises.

Weekly Global News Wrap: Long journey for EU banks' green goals; Wall Street banks to flaunt resilience before Congress

And Greece's Alpha Bank taps JPMorgan, Goldman Sachs for plans to boost capital.

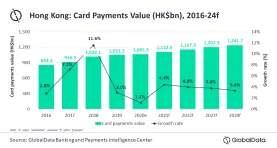

Chart of the Week: Hong Kong card payments value to grow 4.4% in 2021

This comes after two years of decelerating growth due to trade tensions, protests, and the pandemic.

Citi appoints new Singapore head of credit cards and personal loans

Serene Gay will oversee credit cards and unsecured lending covering Citi branded cards.

China’s $1.3t domestic debt hurtles to maturity as defaults surge: report

The huge debt, unprecedented pace of defaults underscores local authorities’ conflicting goals.

Global banks on a hiring craze as they vie for rich Asians’ assets

HSBC, Goldman Sachs, and Citi are all eyeing a piece of the region's trillion-dollar financial market.

China to account for half of mobile payments worldwide by 2023

The country’s mobile payment transaction value is expected to hit $1.3t this year.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership