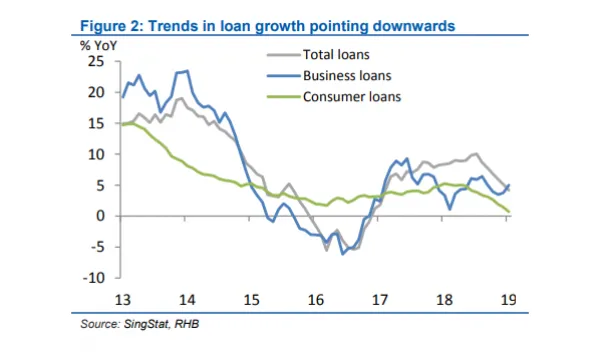

Singapore bank loan growth down to 4.2% in January

Consumer loan growth fell to 0.7% whilst business loans increased 5%.

Singapore bank loans expanded at muted pace in January after loan growth for both domestic and Asian currency units eased to 4.2% at the start of the year from 5.1% in December 2018 , according to a report by RHB Research.

“This continued the trend seen since mid 2018,” RHB Research noted. “Business loans continued to trend higher, but the moderation in consumer loans kept total loans down.”

Also read: Property curbs and trade war are double whammy for Singapore banks

Singapore’s consumer loan growth dipped to 0.7% in January from December 2018’s 1.4% with components including professional and private individuals recording larger contractions.

Meanwhile, loans to businesses grew at a stronger 5% from December’s 3.8% supported by higher growth in loans for agriculture & mining, manufacturing, transport and construction. However, loans to professional and private individuals, as well as business services contracted for the month.

Also read: Singapore banks grapple with tepid margins in 2019

The lower headline figures points to the tightening stance taken by the Monetary Authority of Singapore which have had a compounding impact along with the cooling measures that kicked into effect in July to rein in the rise in residential property prices. In an earlier report, Fitch Solutions expects loan growth to further drop to 0.5% by end-2019 as the commercial banking sector takes a heavy beating from the slowing housing market and decelerating Chinese economy.

Singapore’s M3, including Asian currency units, grew 6% YoY in January as the net foreign position rose strongly alongside growth in private credit, but was capped by softer public credit.

“Given the trend, we expect M3 to grow 4% in 2019,” RHB Research added. “Going forward, we expect loans growth to moderate slightly to 7.2% in 2019. This is premised on a tightening monetary environment and cautious growth in property transactions.”

Advertise

Advertise