Thai banks remain strong as bad loans slow: central bank

They have CAR ratios higher than the central bank’s requirements.

According to a report from Reuters, Thailand’s major commercial banks remain strong with high capital adequacy ratios, while bad loans are rising at a slower pace, the central bank said on Tuesday.

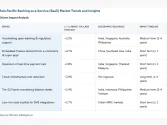

"The comment came a day after the Bank of Thailand (BOT) listed the country’s top five banks as “domestic systematically important banks”, which warrant stricter regulation to ensure they stay secure and to reduce risks to the banking system. An index of bank shares fell half a percent on Tuesday following the BOT’s announcement the previous day, which sparked investor fears that the banks may have problems. The five are Bangkok Bank, Krung Thai Bank , Siam Commercial Bank, Kasikornbank and Bank of Ayudhya," Reuters said.

Read the full story here.

Advertise

Advertise