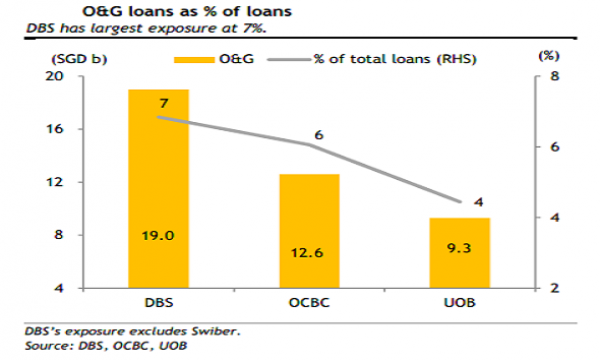

Chart of the Week: See which Singapore bank is most exposed to O&G

This bank has 7% of loans for the sector.

According to Maybank Kim Eng, DBS has the largest exposure among Singapore banks at 7% of loans for the O&G sector.

"If we separate out the upstream and support services segment, which sees more risk than traders and downstream industries, DBS remains the most exposed at 5% of loans, i.e. SGD14b."

Based on channel checks, the analyst estimates UOB’s O&G NPL ratio is 5-6% and UOB’s support services NPL ratio is ~11-14%.

"The higher NPL ratio for OCBC explains the bank’s proactive efforts to place restructured loans as NPLs. 50% of OCBC’s O&G NPLs (~SGD470m) are still performing, i.e. paying interest.

Advertise

Advertise