South Korean banks’ loan delinquency rate rise in February

Corporate, SME, and household loans all saw their delinquency rates rise.

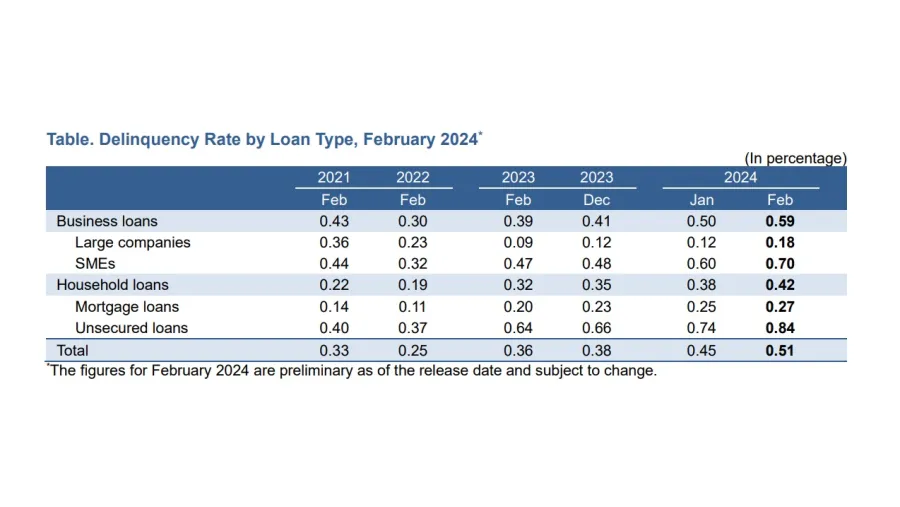

South Korean banks’ loan delinquency rate is 0.15 percentage points (pp) higher in February than the same month in 2023.

The delinquency rate on domestic banks’ won-denominated (WD) loans stood at 0.51% as of end-February 2024, according to data from the Financial Supervisory Service (FSS).

Delinquency rate on loans to large companies climbed from 0.12% to 0.18% between January and February.

ALSO READ: Korean banks to ease lending standards for companies and mortgages

The rate on loans to SMEs also jumped from 0.6% to 0.7% over the same period.

The delinquency rate of household loans also rose to 0.42% in February, 0.04 pp higher than the 0.38% in January.

Advertise

Advertise