Loan mix in China may shift to more mid- and long-term loans

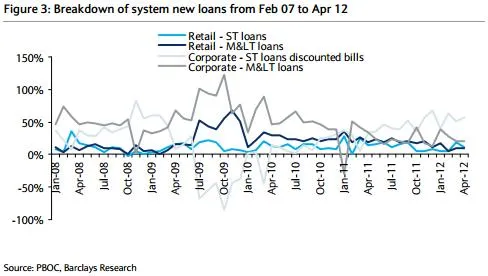

So far loan growth year-todate was mainly driven by short-term corporate loans and discounted bills, says Barclays Research.

According to Barclays analyst May Yan, short-term loans have dominated growth year-to-date. Ahort-term corporate loans and discounted bills contribute 53% to new loans every month on average.

"Loan growth could still be challenging in May driven by growth in short-term loans, domestic news (Shanghai Securities News, May 29, 2012) reported one of the big banks lent around RMB50 bn as of May 28, an improvement from only RMB8 bn as of May 20. However, banks said that significant growth came from discounted bills and short-term loans," said Yan.

Advertise

Advertise