Banks a key entry point for Web3 adoption

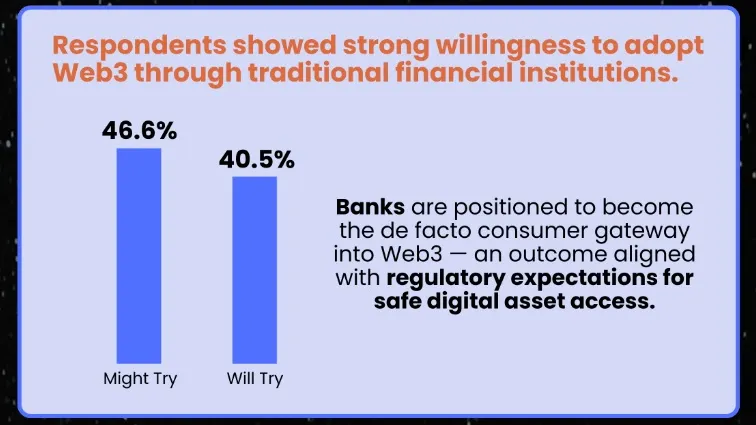

Over 8 in 10 will use or will strongly consider using Web3 services if offered by a bank.

Financial institutions are emerging as a key entry point for people to adopt Web3 services.

In a survey of 1,500 respondents, 40.5% said that they would use Web3 services if provided by their bank, whilst 46.6% indicated that they might, according to Cleanverse International.

Only 4.5% are opposed to the adoption of Web3, the survey found, which was conducted during the Singapore Fintech Festival 2025 that took place between November 12-14.

Web3 is an umbrella term for technologies like blockchain that decentralize data ownership and control on the internet, according to AWS.

The survey suggests that banks are positioned to become the de facto consumer gateway into Web3 — an outcome aligned with regulatory expectations for safe digital asset access.

"Users want Web3 to offer the same level of compliance, identity assurance and value verification that they already expect in traditional finance. This aligns with global regulatory momentum pushing for interoperable trust layers that make digital asset activity safer by design," Cleanverse said in a press release revealing the survey results.

Advertise

Advertise