Malaysia payments flip non-cash as e-wallet usage jumps 14%

Online bank transfers also gained whilst debit and credit cards ranked last amongst users.

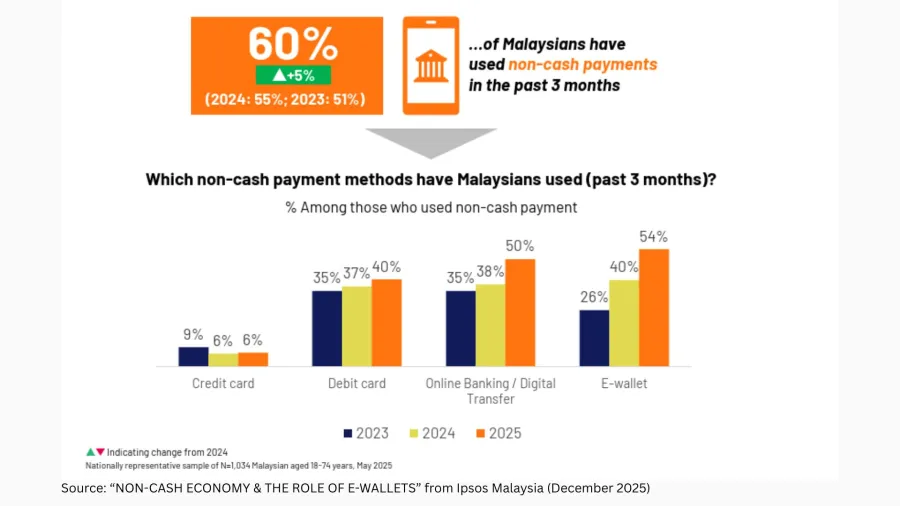

Nearly three out of five Malaysians used digital payment methods in 2025, reflecting a steady shift away from cash, "NON-CASH ECONOMY & THE ROLE OF E-WALLETS" report by Ipsos Malaysia revealed.

Non-cash payment methods have become the main way Malaysians pay for goods and services, with e-wallet usage recording the strongest growth, rising by 14%, followed by increased use of online bank transfers.

Debit and credit cards were the least used by the surveyed participants.

In a different report last year, Malaysia’s payment card market— including point-of-sale (POS) and ATM cash withdrawals— are expected to grow by 4% and be valued at $177.9b (MYR814.1b) by 2025, according to estimates from GlobalData.

Wider card acceptance and contactless cards will play a key role in this growth, the data and analytics company said in a report published in May 2025.

Payments card value in Malaysia registered a compound annual growth rate (CAGR) of 8% between 2020 and 2024 to reach $171.1b (MYR783b).

Cash payments are reportedly steadily declining in Malaysia. The share of ATM cash withdrawals now represents just 49.8% of the market in 2025, lower than the 63.3% in 2021.

Advertise

Advertise