Chart of the Week: Buy Now Pay Later gains traction in Australia

Afterpay remains king, whilst new players seek to carve out their own space.

Buy now pay later is gaining traction as an alternative credit tool in Australia, especially amongst millennials, a study by data and analytics company GlobalData found.

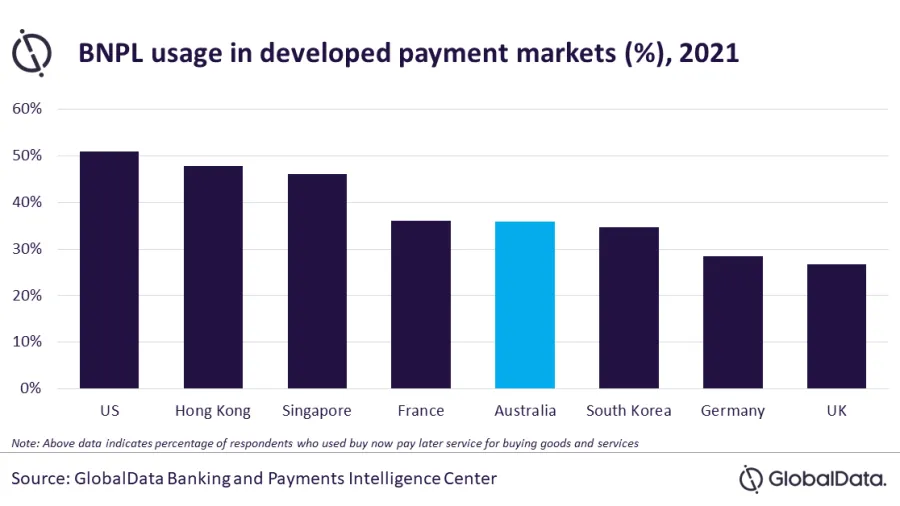

GlobalData’s 2021 Financial Services Consumer Survey saw 36% of Australian respondents admit to using BNPL service for buying goods and services in the past six months.

The COVID-19 pandemic has adversely affected the consumers’ disposable income, creating a demand for short-term consumer financing, which pushed up adoption, noted Ravi Sharma, lead banking and payments analyst at GlobalData.

“The increasing demand for credit coupled with growing consumer preference for e-commerce has made the BNPL service one of the preferred short-term borrowing tools among the consumers,” Sharma said.

Of the BNPL brands operating in the country, Afterpay is the most popular, with 49% of respondents preferring this brand. Zip is at a distant second, with 13% of respondents naming it.

New players are also entering the market. In July last year, PayPal launched its ‘Pay in 4’ buy now pay later service in Australia, allowing customers to pay for purchases in four installments.

Klarna, which entered Australian payment space in December 2020, had already registered over one million app downloads by September 2021 with its customers making payments at over 25,000 merchants.

Advertise

Advertise