buy now pay later

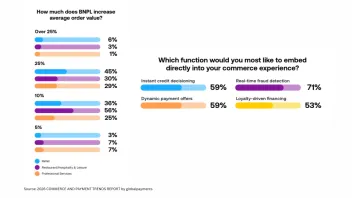

BNPL drives embedded finance as 51% report 25% revenue lift

BNPL drives embedded finance as 51% report 25% revenue lift

40% said average order value rose 25% or more in the same survey

BNPL firm Atome secures $75m facility from Lending Ark

Lending Ark has invested over $1b in Asia.

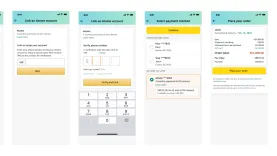

BNPL platform ChopNow announces four new partners

Products available in the platform can be paid in installments.

Four factors shaping APAC’s digital retail payments in 2025

Cash remains relevant in Malaysia and Singapore.

Southeast Asia’s BNPL market to reach $53.2b by 2027

Malaysia, the Philippines, and Indonesia are the most promising markets.\

Atome Financial clinches $200m facility for SEA expansion plans

The digital payments platform reported that it turned EBITDA positive in Q1.

Atome’s BNPL debuts on Taobao Singapore

Every Saturday, Atome shoppers can enjoy a $12 off for a $120 minimum spend.

PH’s BillEase clinched $5m investment from Credit Saison lending arm

BillEase has achieved profitability in 2023 and delivered 47% return on equity.

BNPL provider Atome Financial doubles operating income in 2023

It’s BNPL services are now profitable, the company said in a press release.

Superapps to help drive BNPL userbase to 670 million by 2028

Superapps like WeChat and Grab are adopting and offering BNPL services to users.

Australia’s Zip teams up with Primer to accelerate US expansion

Primer is expected to help drive distribution of Zip’s BNPL services in the market.

PayPal is most popular digital payment option in Asia: study

In the BNPL space, Klarna, Atome, and Afterpay are the region’s most popular choices.

Atome’s buy now pay later service now available in Amazon Singapore

Customers can opt to pay in three installments with zero interest through Atome.

Weekly Global News Wrap: Klarna, Block execs calls UK’s planned BNPL regulations “outdated”; Citi’s global FX head to leave

And fintech Boost looks to raise $50m to $100m in possible new funding round.

Digital wallets on track to be Singapore’s top online payment method by 2026

BNPL is set to surpass US$1b in transaction value by 2026.

Chart of the Week: New Zealand’s BNPL market value to reach $1.2b in 2023

By 2026, the transaction value is expected to grow to $1.9b.

Financial stability a priority for Hong Kong: finance secretary

Chan expects more support from mainland China as the latter’s economy recovers.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership