Less payment delays, longer overdue payments in China

9 in 13 sectors reported an increase in payment delays.

Fewer firms in China encountered payment delays in 2021 however those that did reported longer overdue periods than the previous year, according to the 2022 China Corporate Payment Survey by Coface.

The survey revealed that average payment delay rose from 79 days in 2020 to 86 days in 2021, with firms in nine out of 13 sectors reporting an increase in payment delays. The sectors leading in payment delays were identified as the agri-food , which recorded the largest increase of 43 days, followed by wood, transport, and textile sectors.

More companies are reporting ultra-long payment delays (ULPDs), which are payments overdue by more than six months, rising from 15% to 19% in 2021. There was also a significant increase in those facing ULPDs exceeding 10% of their annual turnover, jumping from 27% in 2020 to 40% in 2021, notably the construction and agri-food sectors.

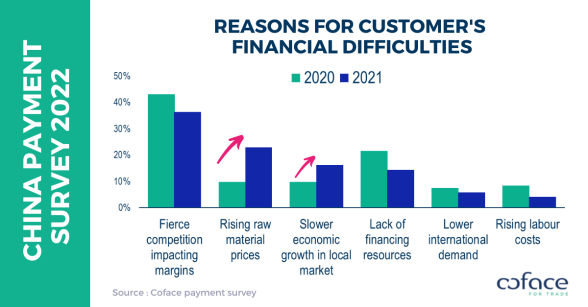

The main reason behind those delays remains customers' financial difficulties, highlighted by nearly three-quarters of respondents that indicated payment delays. Financial difficulties were caused mostly by fierce competition affecting margins (36%), but also — to a greater extent in 2021 — by rising raw materials prices (23% vs. 10% in 2020) and a slowdown in local market growth (16% vs. 10% in 2020). This reflects rising commodity prices that are placing pressure on operational costs which directly impacts companies' cash flow.

Advertise

Advertise