Fitch Ratings

Fitch Ratings is a credit ratings provider. The company also provides commentary, market analysis, and research for global capital markets.

It is considered on of the Big Three credit ratings agencies, alongside Moody's and Standard & Poor's (S&P).

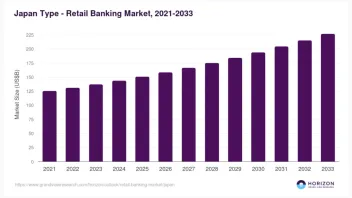

Japan retail banking to hit $227b by 2033

Japan retail banking to hit $227b by 2033

Market revenue stood at $143.7b in 2024 with 5.2% annual growth projected.

India’s banks poised for growth despite margin and cost pressures

Impaired loans ratio and credit costs for most banks have bottomed, Fitch said.

SoKor, Taiwan, Thailand's banks face deteriorating outlook on trade exposures

These three have hig export exposure and sales to the US.

APAC emerging market banks to enjoy double digit credit growth: report

China and Thailand will feel the most pressure, especially Chinese banks’ margins.

Sri Lanka and Vietnam banks to boost 2025 financials

Sri Lanka’s political crises are receding; Vietnam will be lifted by higher loan growth

Fitch forecasts growth in Philippine Islamic finance sector

The government plans to incorporate sukuk in its 2025 financing mix.

China's G-SIBs on track to meet minimum TLAC: Fitch

The five banks have issued about $110.12b in capital instruments yearly since 2019.

Chinese small bank M&As to ramp up: Fitch

The lack of large banks in the mergers is to avoid contagion risks.

Basel III to improve Japanese major financial groups’ profits

However, risk-weighted assets for the four FIs are expected to rise.

Steady margins and higher trade gains buoy Vietnamese banks’ profits in H2

Asset quality risks are expected to remain contained, Fitch Ratings said.

Thai banks grapple with slowing exports and weak consumer sentiment

Fitch has revised its loan growth estimates to 3% from 5% previously.

Taiwan banks show stable asset quality

Fitch sees a favourable outlook for Taiwanese banks in the next 2 years.

Australia, NZ retail banks face tougher headwinds

Both loans and deposits will see increased competition.

Indonesian banks tout sound profitability and capitalisation

Only a fraction of restructured loans will become bad loans, Fitch said.

Overseas expansion impacts Korean banks’ OE score

Despite Korea's high GDP per capita, the current level suggests there's still room for improvement.

Revised rules bolster car loans but with influx of lower quality borrowers

The asset quality of auto finance companies will be tested.

Japan to break free from negative rate policy after wage hike: analyst

The negative rate environment is likely to end in April 2024.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership