What kids without wallets can teach us about the future of finance

By Sandeep MalhotraThe next generation isn’t waiting—and neither should we.

In the Asia-Pacific (APAC) region, a quiet revolution is underway—led not by seasoned investors or fintech disruptors, but by children.

Gen Alpha, born from 2010 onwards, is growing up in a world where money is more likely to be tapped than counted, and where financial literacy begins not with a piggy bank, but with a smartphone.

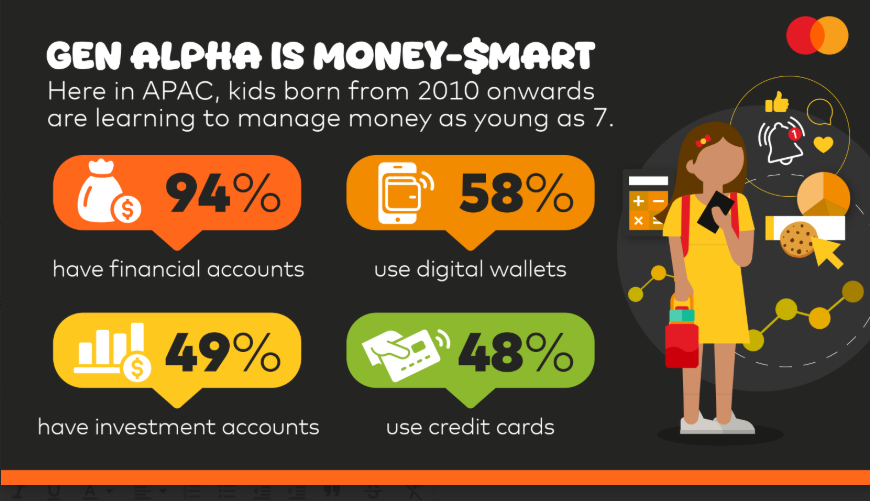

According to Mastercard's research, 94% of Gen Alpha children in APAC already have access to a financial account. About half hold digital wallets (58%), investment accounts (49%), or even credit cards (48%).

These aren’t just digital natives; they are early adopters of financial tools, often outpacing their parents in digital fluency and financial confidence whilst challenging traditional notions of financial education.

This shift isn’t just fascinating—it’s a strategic signal. Gen Alpha is offering a window into what is expected from the financial world, both today and in the future: intuitive, embedded, and confidence-building experiences.

For banks and financial institutions, the message is clear: designing for this generation sets a new benchmark for relevance and resilience.

Digital fluency is now a given

What sets Gen Alpha apart isn’t just early exposure to financial tools; it’s how naturally they engage with them. They’re not learning to use digital wallets; they’re growing up with them. They don’t see budgeting apps as utilities, rather, they see them as part of their digital ecosystem, alongside games, messaging apps, and learning platforms.

This fluency is reshaping the parent-child dynamic. Nearly half (47%) of Gen Alpha parents say their children have introduced them to digital financial tools they didn’t know about. In many households, the traditional flow of financial wisdom—from parent to child—is reversing.

For the payments sector, this is a mandate to evolve. It’s no longer enough to offer sleek interfaces or faster transactions. Tools must evolve with the user, supporting their journey from first tap to financial independence. If a 10-year-old can’t intuitively navigate your platform, it may not be ready for prime time.

Designing for confidence, not just convenience

The goal of financial innovation has long been convenience. But Gen Alpha is pushing us to think bigger.

What they need—and what their parents want—are tools that build confidence. That means more than just easier or safer payments. It means experiences that teach, adapt, and empower.

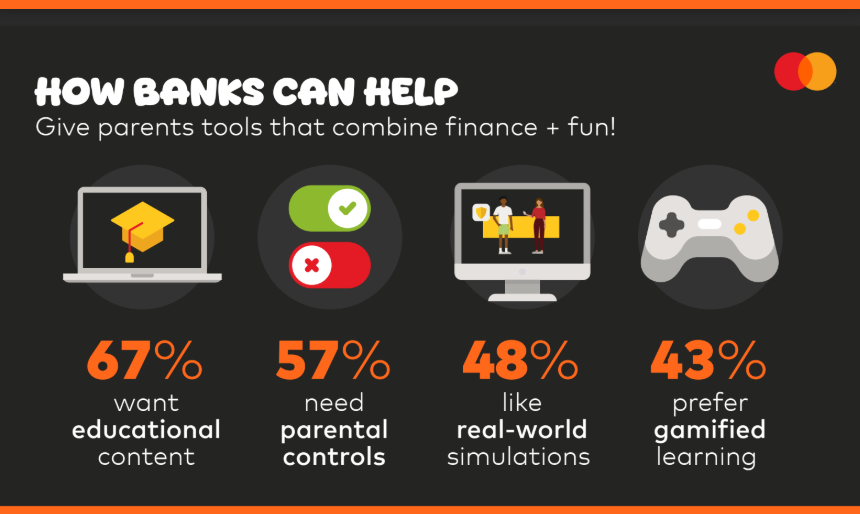

What the research clearly shows is that there is strong demand for features like educational content (67%), real-world learning simulations (48%), and gamified experiences (43%). These aren’t just bells and whistles; they’re the building blocks of financial confidence.

When a child learns to save or budget through a game or sees the impact of a spending decision in a simulation, they’re not just playing, they’re preparing for their financial future.

The new rules of relevance

Designing for Gen Alpha is also an investment in broader inclusion. In APAC, where fast-growing markets like Vietnam, Indonesia, and Malaysia are leapfrogging into mobile-first ecosystems, financial tools must meet users where they already are: on super apps, in social commerce, and through peer-to-peer platforms.

This isn’t just about access — it’s about agency. Consumers increasingly expect seamless, embedded experiences that offer transparency and control.

In fact, 70% of APAC consumers want all-in-one apps to manage payments, shopping, and more. And with nearly 40% already transacting through social or messaging apps, the shift from browsing to buying is happening in real time.

For financial institutions, this is a strategic opportunity to lead with relevance. By embedding trust, personalization, and education into every interaction, we can build systems that not only serve Gen Alpha but elevate the experience for all.

Gen Alpha is ready. Are we?

The rise of Gen Alpha is a wake-up call for banks, fintechs, educators and parents alike. It’s time to move beyond retrofitting legacy systems and start designing for digital fluency from the ground up.

That means embedding education into every financial interaction so learning becomes a natural part of using money. It means prioritising intuitive design that empowers users of all ages, making financial tools as easy to navigate as the apps they already use.

At the same time, innovation must be balanced with trust. As digital natives, Gen Alpha expects seamless experiences but they also demand transparency and control, especially when it comes to data and security. Financial tools must offer experiences that grow in complexity and capability as the user’s financial competence increases.

The next generation isn’t waiting—and neither should we. Gen Alpha is already shaping the future of finance. Let’s meet them there with tools that are intuitive, inclusive, and built for real-world confidence.

The financial institutions that design with them in mind won’t just stay relevant—they’ll stay in the driver’s seat.

Note: The author references data from a global research study conducted by The Harris Poll on behalf of Mastercard. The survey gathered responses from 19,302 consumers across five global regions, including 9,131 consumers in Asia Pacific. The study was conducted via a quantitative online survey, administered from September 4 to September 20, 2024. It covered five regions: North America, Latin America and Caribbean, Europe, Middle East & Africa, and Asia Pacific. APAC markets included Australia, China, India, Indonesia, Japan, Malaysia, Singapore, Thailand, and Vietnam.

Advertise

Advertise