Refinitiv

Refinitiv is one of the world's largest providers of financial markets data and infrastructure with over 40,000 customers and 400,000 end users across 190 countries. It provides information, insights, and technology that enable customers to execute critical investing, trading and risk decisions with confidence.

See below for the Latest Refinitiv News, Analysis, Profit Results, Share Price Information, and Commentary.

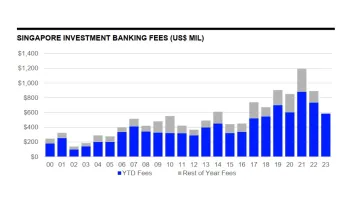

Singapore’s investment banking fees decline on fewer M&As

Singapore’s investment banking fees decline on fewer M&As

Banks also recorded lower DCM fees compared to the first nine months of 2022.

APAC investment banking fees drops 8.5% in Q1 2022

This comes after its all time high in the same quarter last year.

APAC’s total investment banking fees in 2021 highest-ever on record

The region recorded its highest-ever equity capital market fees collected in a year.

Refinitiv launches electronic trading service in Indonesia

This is the country’s first interbank electronic marketplace for the trading of rupiah.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership