Exclusive

CIMB lets you open an account online without visiting a branch

Check out how Kwik Account can benefit you.

Asian banks should brace for these nasty challenges in supply chain management

Trade finance executives from OCBC, BPI, and Techcombank share their insights.

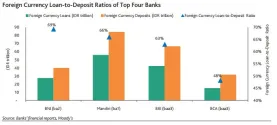

Why excessive un-hedged borrowings won't be a concern for Indonesian banks

They've kept their loan-deposit ratios low.

Singapore, Aussie banks dominate world’s top 10 safest commercial banks

DBS, OCBC, and UOB are in the top 5.

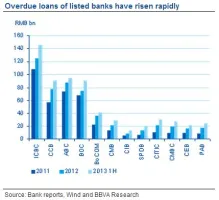

Why you must not be fooled by Chinese banks' good 1H13 profit results

The sharp overdue loans increase suggest weak underlying trends.

Only 1 in 5 Asian SMEs use FX options and forward FX

Malaysian businesses are the least engaged in these products.

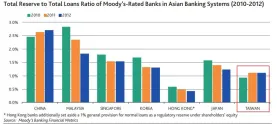

This graph shows the total reserve to total loans ratio of Asian banks

Taiwanese banks' level is low compared to peers.

Top 10 world’s safest banks 2013 in Asia

Singaporean banks dominated the top three.

See how Singapore banks have expanded regionally as at 2Q13

UOB is the only Singapore bank with Thai operations.

4 benefits of Standard Chartered's new Universal Adaptor online tool

Around 500 clients are already enjoying this online tool.

Check out ANZ's new mobile financial service for unbanked consumers in the Pacific

ANZ is using Mobiliti Reach from Fiserv.

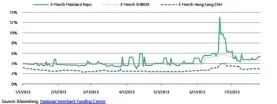

This graph shows a comparison of 3-month Mainland repo rate, Shibor, and HK interbank rate

See how they affect each other.

Check out the intelligent network infrastructure in Bank of China's Tianjin office

12,600 outlets inside offices and the data center were connected.

Looking at Asian companies' transaction banking relationships from a historical perspective

They want more than commoditised service.

This is why the currency's decline is credit positive for Australian banks

It reduces the banks' offshore funding task.

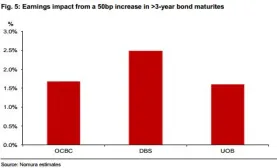

Here's how Singapore banks will be affected by a 50bp increase in 3-year bond maturites

Guess which bank will benefit the most?

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership