Exclusive

Find out more about the ambitious 2015 Asia strategy of SWIFT's new deputy chief executive for Asia Pacific

Find out more about the ambitious 2015 Asia strategy of SWIFT's new deputy chief executive for Asia Pacific

Patrick de Courcy shares his 3 goals following his appointment.

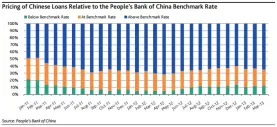

Only a small portion of China banks' new loans priced below PBOC's benchmark rates

Most banks expected to retain their pricing power.

UOB pilots online service for Gold and Silver savings accounts

One in five customers already used the service.

This graph shows Singapore banks' assets by geography

Assets outside Singapore grew at a 15% CAGR.

Westpac's new institutional banking head for Asia David Koh dead set on building Australia’s first bank in Asia

Find out what his other 2 goals are.

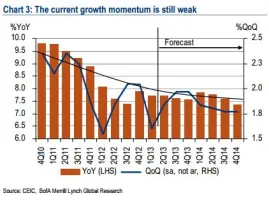

Why the worst may be over for China's credit crunch

Current growth rate is quite close to the floor.

These 9 Chinese commercial banks may consider IPO in Hong Kong

Concerns over banks' capital consumption arise.

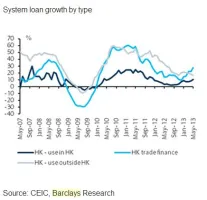

See what led Hong Kong banks' stable system loan growth at 1.7%

Cheaper borrowing costs are a boon.

You won't believe how fast you can send money to any Visa cardholder overseas with DBS' new service

Funds transfer has never been this convenient.

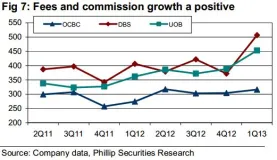

Here's why wealth management will be Singapore banks' cash cow in 2013

DBS and UOB posted record-high Fees and Commission.

Here's how OCBC lets Singapore investors buy STI stocks for as low as S$100 a month

Blue chip stocks are no longer out of reach.

Top 10 Hong Kong banks by total assets

Guess which bank led the pack with total assets of HK$5.6t.

JP Morgan unveils its enhanced online banking platform in Asia Pacific

ACCESS lets clients do financial transactions in a single location.

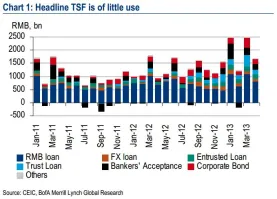

Why headline TSF is 'of little meaning' to calculate China's credit growth

It's a 'second derivative' of credit.

Only 10% of Asia's rich with median investable wealth of US$4.22m use a private bank

But 15% said they will do so in 2014.

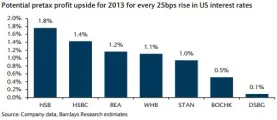

Check out how rising interest rates will affect Hong Kong banks' profits

Hang Seng and HSBC will benefit the most.

Citi China launches Citi Mobile Collect

Find out what the major differentiating factors are.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership