For French fintechs, Asia is a land of opportunities and learning

Compared to Europe, fintechs in Asia have struck a balance with banks, says Bpifrance Deputy CEO Arnaud Caudoux.

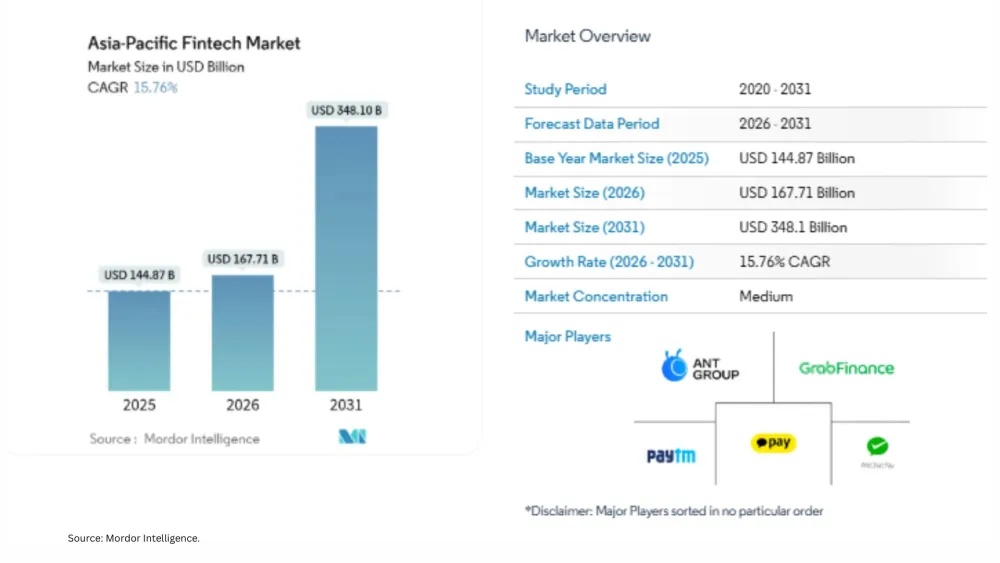

Boundless opportunities abound for financial technology (fintech) companies in the Asia Pacific. Fintech investments in the region hit a record high of $41.8b during just the first six months of 2022. The region's diversified economy—driven by modernisation, regulation, sustainability, and crypto—makes it a prime destination for fintech companies to tap into new revenue streams.

During the recently concluded Singapore Fintech Festival 2022, French investment bank Bpifrance, in partnership with Aurexia, brought a delegation of nine French fintechs to Singapore to give them a taste of the market.

“A lot of these companies may want to expand in the APAC region, and we want them to get a taste and a feeling of what the market is like,” Arnaud Caudoux, Deputy CEO of Bpifrance, told Asian Banking & Finance. “This market is very different from the European markets. The companies can get inspired by what they see happen faster, and they may see a lot of opportunities at present based on what has been shown here. It's a mix of opportunities, and learning.”

Asian Banking & Finance spoke with Carudoux to learn more about the delegation, the difference between the APAC and European fintech markets, and what opportunities they see in APAC.

How did Bpifrance vet the 9 fintechs? Why did you choose to present these fintechs specifically?

We have a network of branches across France—around 50 branches—which deal with French startups and companies on a daily basis. We have one thousand people in these branches, so we know all these companies very well.

When we organise this kind of expedition, first we ask our branches for a specific region: in this segment of business, who would you send? They come up with let's say 50 names. And so we have 50 names of fintechs that would be fit for Asia, and Singapore. Then we make a second selection from these 50 companies: which one do we know best, which are the best ones, who do you really want to take with you for one week in Asia, and we just select out of the 50.

The most important part is we have the ability to identify companies across France, and then we make the selection from a shortlist. In this particular case, we selected companies from the crypto industry, companies from the cybersecurity industry, and basically companies specialised in data analytics for risk management and for finance management.

Arnaud Caudoux, Directeur Général Adjoint de Bpifrance.

What pain points are these fintechs looking to fill in APAC? Can you give us three to five reasons why you chose to enter APAC’s fintech space?

I would not pretend I see pain points in APAC. I don't see them. I'm here also to learn. I don't know APAC too well, but what I can see is what has gone fast, and what has gone slow. In Europe, what has gone fast, for instance, is regulation. We're very good at regulation. If you look at ESG issues, ESG for financial data, I think it has gotten faster in Europe, because of regulations in Europe.

For instance, some of these fintech companies can really be helpful here in the crypto area. I think it's still very open [and] we have some very good companies in Europe, we have very good tech in the blockchain area.

It's not about pain points. It's just a land of opportunity. I think the regulation is softer here. So it's good for these companies to develop in both Europe and in Asia, or Europe and the US, because you have different regulatory playgrounds and you don't know what will be the end game, so you need to try different things. So it's not really about pain points.

I think the big difference between Asia and Europe is the place of the incumbent banking industry. In Europe, you have a very strong incumbent banking industry, [and] everyone is banked. In Asia, you still have a lot of unbanked people. And at the same time, you have very good financial hubs like Singapore. So it's a very interesting mix between very mature industries and very open markets. Whereas in Europe, it's tougher to address.

Why do you think APAC is a market suited for the French fintechs to conquer?

No, I think it's suited for some companies. Not for all. But I think it's super easy, if you're a data analytics provider, if you're in the regulatory area, you’re a fit. And definitely, if you're in the environmental transition industry, the ESG part of the business, it is very suited too because we have a lot of constraints already in the EU, to which people have had to adapt.

How do you see France’s fintech market and how does it compare to APAC?

I think we have bigger companies that are much more dynamic in terms of market growth. We have very good technology in Europe too. Companies are a bit slower in growth but very sharp, because the competition is intense, which includes banks.

One of the big differences I observed [here in Singapore] and from my previous trips is that the partnership between banks and fintechs is more efficient here in Asia. If you look at the relations between DBS and fintechs, in Singapore, it's very intense. We have this in Europe, but the balance between fintechs and banks is not the same. Banks are bigger and not as keen to partner.

A bit of the same thing for regulatory authorities. I think MAS here in Singapore has done a great job collaborating, even if it's difficult and even if they are still trying to find the right balance. They have been very open to crypto, so they had some failures. But now moving forward, they are trying things, which is a very interesting approach. I like it.

How are you enjoying your experience in SFF?

So far, so good. It's really huge. We don't have this kind of festival in France, and although we have a very good fintech festival, it’s much more targeted. Here it's a bit like the Olympic Games where everyone is participating. You can feel that for some of them, it's really important to just be here and participate. Some are clearly here to win; we're here to win.

Advertise

Advertise