Mortgages drive demand for South Korean household loans in August

Demand for other loan types fell, however.

Household loans grew faster in August, thanks to increased demand for mortgages.

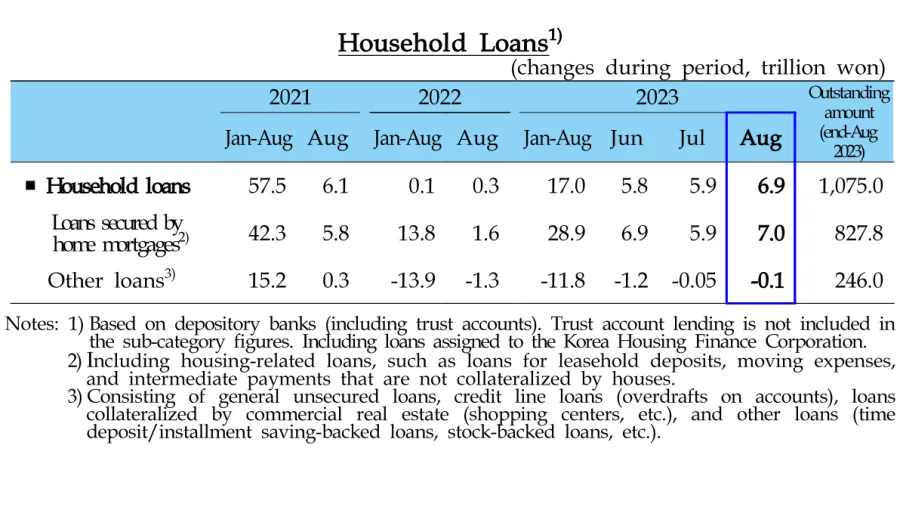

Bank lending to the household sector– including loans assigned to the Korea Housing Finance Corporation– grew by approximately $5.2b (KRW6.9t) in August, according to data from the Bank of Korea (BOK). This is higher than the over $4.44b (KRW5.9t) in household loans added in July, and far higher than the $226m (KRW0.3t) won growth recorded for August 2022.

ALSO READ: Revised rules bolster Korean banks’ competition, but no silver bullet to thriving: analysts

Home mortgages boosted numbers, increasing by KRW7t. BOK noted higher demand for funds related to housing purchases, despite slowing demand for funds for leasehold deposits. Leasehold deposit loans declined by $75m (KRW0.1t) in August.

Demand for other types of loans also continued to decline, recording a KRW0.1t decline in August compared to July.

Advertise

Advertise