Bank of Korea

South Korea’s industrial lending up $2.27b in Q4 2024

South Korea’s industrial lending up $2.27b in Q4 2024

Loans to working capital fell but rose for facilities investment.

Korean banks’ lending to corporates, SMEs rise in August

Loans extended to large corporations and SMEs both rose during the month.

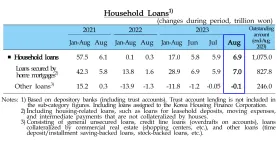

Mortgages drive demand for South Korean household loans in August

Demand for other loan types fell, however.

South Korean banks to further ease lending in Q3: report

Household loan growth has slowed as borrowing costs rose, according to Yonhap.

Banks in South Korea are expected to further ease lending in the third quarter, even as credit risks are expected to rise, reports Yonhap, based on a survey conducted by the Bank of Korea (BOK).

An index gauging banks’ attitude toward home-backed loans and unsecured household lending stood at 14 and 19, respectively, for the July-September period, according to the findings of a poll of officials handling credit affairs at financial institutions (FIs)—which include 18 banks.

A reading above zero means the number of lenders that will ease lending surpasses that of banks planning to tighten lending criteria.

South Korea’s deposit, loan interest rates rose in May

Average interest rate for new deposits rose 15 basis points from April.

South Korean banks’ mortgage rates hit highest level in seven years: report

The loan rate averaged 3.63% in December, 0.12 ppt higher than a month earlier.

South Korean banks' lending fell in December

This marked the first on-month decline for a month of December since 2004.

South Korea’s corporate loan growth quickened in Q3: report

This was thanks to a rise in loans made to the service sector during the period.

South Korean banks’ average mortgage rates hit three-year high: report

The 3.26% interest rate average is its highest since November 2018.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership