Thailand’s Krungsri launches SME transition loan for clean energy

It will help businesses embrace clean energy solutions and reduce pollution.

Thailand’s Bank of Ayudhya has launched the Krungsri SME Transition Loan aimed at helping small and medium-sized enterprises (SME) transition to clean energy.

The loan features credit lines of up to 10 years, with a special fixed interest rate of 3.5% for the first two years. It will cover up to 100% of the project value.

It is offered to businesses in the manufacturing, trading, and services sectors, said Duangkamol Limpuangthip, Krungsri head of SME Banking Group.

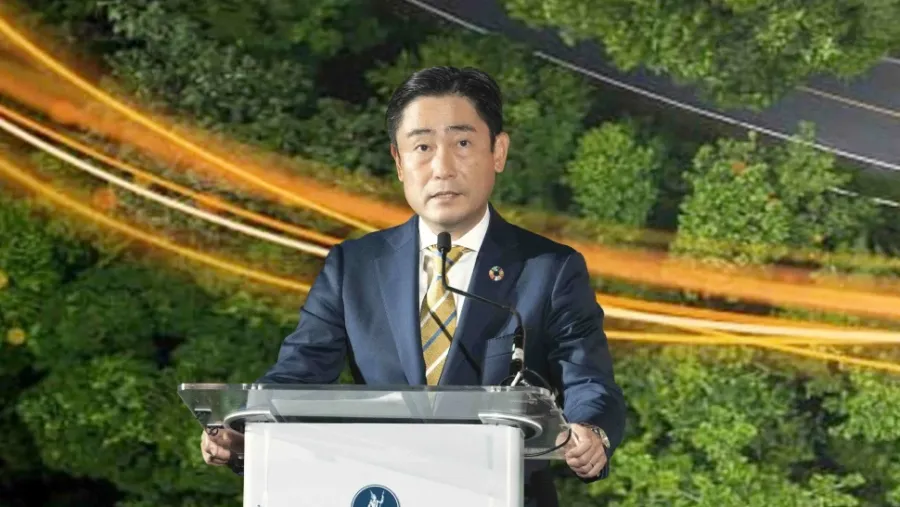

“It provides essential funding for SMEs to implement projects that reduce pollution and embrace clean energy solutions, ensuring business resilience against the impacts of climate change,” Krungsri CEO and president Kenichi Yamato said, commenting on the loan’s launch.

Project examples include installing EV chargers; purchasing, constructing, or renovating energy efficiency factories; investing in wastewater treatment facilities; and implementing circular waste management systems, said Limpuangthip.

Advertise

Advertise