Malaysia

CIMB adds retirement planning to insurance solutions

CIMB adds retirement planning to insurance solutions

This is through a partnership with Sun Life Malaysia.

What provisions will trend post-MFRS 9 implementation?

Malaysian banks adopted the new standard on January 1, 2018.

Malaysian banks' credit growth hits 5.5% in Nov 2017

It compensated for the sluggish 3.9% industry loan growth.

Malaysian banks' earnings growth to slip to 6.5% in 2018

It's a steep decline from the 13.4% profit growth in 2017.

Malaysian banks' core net profit forecast to grow 5.8% in 2018

Earnings growth could taper off next year.

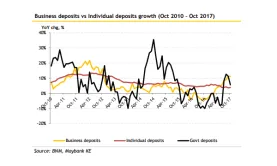

Chart of the Week: Malaysian banks' business deposits vs individual deposits growth

More than a third of total deposits are business deposits.

AmBank's total income up 2.3% to US$477m

Thanks to higher net interest income and improved NIMs.

Malaysian banks' loan growth slows to 4.6% in October

But household loan growth sustained its upward momentum.

Malaysian banks' gross impaired loans ratio stable at 1.67%

GIL ratios were stable across most asset classes.

CIMB receives regulatory sandbox approval for e-KYC

It's the first Malaysian bank to receive such an approval.

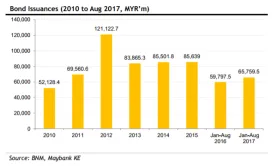

Malaysian banks' bond issuances up 26% to US$4.3b in September

Issuances for the first nine months of 2017 hit US$20.3b.

Malaysian banks' total loans post weaker growth of 5.2% in September

Blame it on sluggish business loans growth.

RHB Bank launches Banking-at-Your-Doorstep service

It also unveiled the MyHome app.

ATM & Cash Innovation Asia 2017 to take place on November 22-23

The conference will be held at the Shangri-La, Kuala Lumpur.

Chart of the Week: Malaysian banks' bond issuances up 10%

Issuances hit US$2b in August 2017.

These initiatives could help Malaysia remain a regional Islamic banking hub

New human capital development programmes will complement existing ones.

Asian Islamic banks seek synergies amidst sea change in fintech, regulations

Islamic banks are grappling with digitalisation which has taken conventional banks by storm.

Advertise

Advertise

Commentary

The future of Asian banking isn’t ‘AI-first’ – it’s ‘fearless-first’

Why APAC banks must rethink their approach to the cost reduction challenge