Malaysia

2018 Retail Banking Forum - Kuala Lumpur a success with more than 60 attendees

2018 Retail Banking Forum - Kuala Lumpur a success with more than 60 attendees

Key executives from Malaysia's major banks graced the event.

CIMB waives fees on online and mobile fund transfers

The move is in line with the central bank’s cashless push.

RHB Islamic Bank Berhad unveils corporate debit card to slash cash and cheque use

It acts as an alternative for businesses to pay local government agencies.

Why you should not miss the 2018 Retail Banking Forum in Kuala Lumpur

The event will be held on April 25 at the Shangri-La Hotel, Kuala Lumpur.

Can Hong Leong Bank's digital strategies accelerate productivity?

The bank was the first to adopt cognitive banking technologies in Malaysia.

Malaysian banks shrug off debt to buffer against market shocks

A decline in high-risk consumer loans prompted weaker household debt growth in 2017.

Can Islamic fintech gain momentum in Malaysia?

Analysts believe in the sector's growth potential to buoy loan growth in the next five years.

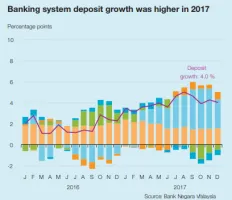

Chart of the Week: Check out the composition of Malaysian bank deposits from 2016 to 2017

Deposits grew 4% YoY in 2017.

Hong Leong Bank unveils AI-powered chatbot

‘HALI’ will answer staff queries on HR procedures like medical benefits and leave policies.

RHB Bank launches chatbot for credit card applications

The real time messenger platform will be available on RinggitPlus.com.

Is Islamic financing the future of Malaysian banks?

It grew 10.3% unlike conventional banks which rose marginally by 1.7% in 2017.

Home loans buoy Malaysian banks' growth prospects

It’s the only bright spot amidst the rest of the underperforming pack.

Malaysia expected to ride Islamic finance boom

Sukuk issuance amongst banks may grow as much as 13% in 2018.

Malaysian banks poised for greater profitability amidst loan demand recovery

Improved asset quality is also in store for banks with O&G exposure.

CIMB unveils one-minute home financing approval feature

Its biometric fingerprint identification also provides for enhanced security.

CIMB unveils cross-border banking for Singapore and Malaysian customers

This enables fee-waived fund transfers, preferentail forex rates, and bill payments.

RHB Bank Berhad profit up 16% to $496.88m in 2017

Higher net funding income and lower impairment losses on loans boosted yearly earnings.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership