Philippines

Philippine bank lending hits 9.2% in December

Philippine bank lending hits 9.2% in December

Loans to non-residents declined faster than the previous month, however.

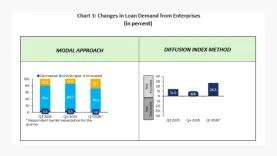

Steady loan outlook erodes as Philippine banks brace for Q1 squeeze

Banks expecting a flat borrowing appetite fell significantly from a previous high of 80.7%.

Philippine banks signal credit squeeze as tightening bias grows in Q1

About 12.8% of banks expect to tighten credit standards for household loans.

QBE deal expands as Malayan embeds add-on into RCBC auto loans

Paramount Life and General Insurance Corporation acts as the local partner in the Philippines.

Security Bank names new wealth segment head

The Philippine bank also announced the retirement of EVP Gina Go.

RCBC names AREIT CEO as independent director

Independent director Erika Fille Legara has been named to the advisory board.

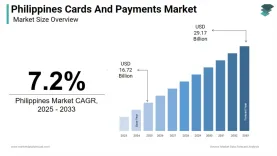

Philippine payments market to hit $29.17b by 2033

The report places 2025 value at $16.72b and tracks a climb from 2024 baseline levels.

Moneymax launches credit push as 95% of Filipinos “credit invisible”

The company will release guides and hold webinars in partnership with the CCAP.

GCash bundles free Oona insurance with GLoan credit disbursements

This new in-app feature is only for a limited time.

PH central bank warns public against scammers posing as employees

The BSP will never ask the public to transfer funds from their accounts, it said.

BSP extension lets banks write bigger green loans beyond 25% cap

Banks can exceed the single borrower’s limit by an additional 15%.

BSP mandates ISO 20022 adoption across retail payments in Philippines

BSP said it will establish an ISO 20022 Harmonization Industry Project Team to coordinate the industry-wide transition.

Philippine FCDU loans fall 3.9% in September 2025

This is despite the 5.7% growth in deposits in foreign currencies, the central bank said.

Sun Life Grepa and Top Bank Philippines ink partnership agreement

Top Bank Philippines will integrate insurance solutions in its services.

PNB inks loan facility agreement with DCFC to boost SME lending

The facility will be used to grant working capital loans to SMEs.

UnionBank names Gauraw Srivastava as wealth head and EVP

Srivastava was previously head of private banking at Vietnam’s VPBank.

UnionBank rolls out payroll account opening solution

Employees can open accounts by scanning a QR code.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership