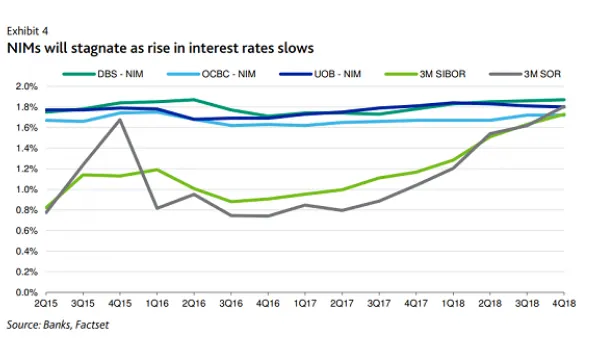

Chart of the Week: Singapore banks' NIMs rose to 1.8% in 2018

DBS outperformed OCBC and UOB with its NIM widening 9bp.

This chart from Moody’s Investor Services showed that the the net interest margins (NIMs) for Singapore’s three big banks hit an average of 1.8% in 2018 from 1.75% in 2017.

DBS outperformed the other two with its NIM widening 9 basis points because of lower funding costs, compared with 5 basis points increase for OCBC, and 1 basis point decline for UOB.

NIMs are set to stagnate in 2019 because interest rates will rise more gradually in line with the worsening economic prospects, Moody’s said.

Also read: Singapore banks fare better than Indonesian lenders amidst rate hikes

“Interest rates in Singapore typically move in tandem with US interest rates, and the pace of further rate increases in the US will slow in 2019, with the Fed turning more cautions with monetary policy tightening and balance sheet reductions,” they explained, adding that stiff competition amongst banks for new mortgage financing and refinancing will deter banks from raising loan rates, which in turn will constrain NIM improvements.

“Further, low-cost current account savings account (CASA) deposits at the three banks are decreasing as depositors gravitate to higher yielding fixed deposits to take advantage of rising rates,” Moody’s said. “This shift will lead to higher funding costs and weigh on NIMs.”

Advertise

Advertise