Five financial self-service trends you cannot afford to ignore

Omnichannel experiences will soon become standard operating procedure.

RBR research found more than three million ATMs in use around the globe in 2014 – and that number is projected to grow to four million as financial institutions in emerging markets connect with the un- and underbanked through the self-service channel. Meanwhile, the number of branches is contracting as banks contend with outsized expansion in the ‘90s and ‘00s and cultural shifts toward mobile and digital banking.

Vast changes are taking place across the entire financial industry, and in the coming years omnichannel experiences will become standard operating procedure. Has your organization appropriately addressed and prioritized the challenges you must address if you want to continue to be successful and profitable?

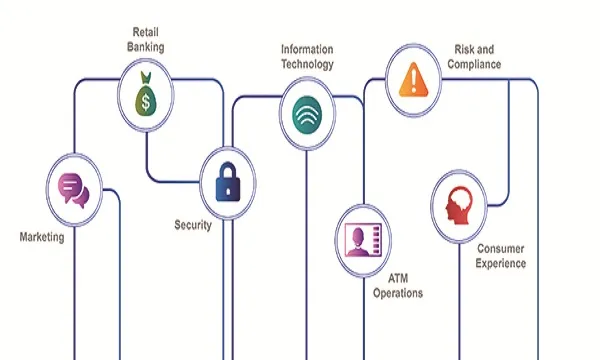

From where I sit on Diebold’s software team, I see five key trends taking place in the financial self-service sector that should be on your radar and in your strategic planning materials – these trends shaped our new software platform and continue to guide our technology roadmap.

1. User experience expectations are higher than ever.

Globally, we’re glued to screens on a regular basis. We even multi-task with “second” and “third” screens. We’re savvier at interacting with technology – and our expectations for that technology are high. There is simply no excuse anymore for a self-service terminal that’s awkward to use or access.

Today’s ATMs must rise to the level of the technology we use in our everyday lives; that means more intuitive controls and functionality, more inviting design, more thoughtful user interface. A self-service transaction should be seamless and painless for your consumers. Self-service terminal maintenance should be seamless and painless for your staff.

The engineering and design of our software platform and our latest terminals was guided by UX principles. We spent a year visiting financial institutions, branch tellers, CIT personnel and end consumers around the world to understand their biggest pain points around self-service automation. Of the many advances we made, there are a few innovative features I find particularly beneficial:

Optional second screen. We future-proofed the design to enable two-way video access, better privacy for advanced transactions, targeted marketing and a host of other consumer-facing features.

Vertical cassettes. The new orientation enables staff and CIT personnel to pull cassettes out with one hand and remain standing during cassette changes, so it’s a more ergonomic experience – and a safer one.

Biometric accessibility: Biometrics’ time has arrived. When we unveiled iris-scanning authentication on our new concept terminal at Money20/20, it got a lot of attention. But beyond the cool factor, biometrics offer an alternative authentication path that ensures security and broadens accessibility.

2. Multi-vendor environments are the norm, not the exception.

Consumers expect a consistent, secure experience at the ATM, and they don’t care what’s going on behind the scenes. Your software and hardware must be able to work together in current state conditions – but you’ve also got to be prepared for the unknowns of the future, and the drive toward omnichannel transactions. Will your ATMs be able to keep up with necessary upgrades, updates and changes?

Our software team is often asked by potential clients to perform proof of concept (POCs) with Diebold VISTA™ terminal application software in a multi-vendor environment, and the feedback is always the same: they’re surprised at how fast and reliably we’re able to get their terminals up and running (typically in just a couple days).

3. Mobile integration is changing the way consumers interact with your self-service channel.

If you haven’t heard of M-Pesa by now, brush up on their success story in Africa – and expect more of it to come. Fintech disruptors are jumping on mobile and digital from every conceivable angle, and consumers have an appetite for it. In fact, mobile banking surged past branch banking in popularity in 2015, according to Javelin Strategy & Research.

We design omnichannel solutions that enable people to tap into the physical and digital worlds of currency however, whenever, wherever they want. Our most recent concepts are exciting proof points to that story, with solutions like SafeLoad, a secure mobile-wallet download driven by near-field communication (NFC), and Irving, a mobile-first cash-dispenser with some incredibly exciting potential use cases.

4. The ATM channel has become a strategic, vital touchpoint between your organization and your consumers.

As branches are closing or being reformatted, self-service devices are one of the most mission-critical touchpoints you have with your consumer. In a world where the products and services you offer are becoming commoditized, there’s a renewed opportunity to deliver a differentiated, customized experience through your self-service network.

Think about this: at an ATM, your consumer is known (through card and PIN verification), in a banking state of mind and standing in front of a large screen where they can act. It’s an optimal time to engage with them. Solutions like COMMANDER™ Marketing Suite introduce a server orchestration layer that drives an omnichannel retail banking environment and enables personalization and 1:1 marketing.

5. Analytics capabilities are enabling banks to differentiate through service and customization.

Preventative maintenance, intelligent service delivery and the ability to truly understand your consumers (individually and at an aggregate) … these will all be keys to success in the coming years.

Interestingly, a new report from the Financial Brand notes that FIs are not yet prioritizing analytics: “National and regional banks have the desire to improve analytics capabilities as their third highest “top three” priority (47%). The emphasis on advanced analytics completely overshadows the level of emphasis indicated by both community banks and credit unions (8% ranked this as a “top three priority).”

Analytics cannot be ignored – and your ATM network is one of the best places to gather data about your consumers. When you’re paying for online ads, you pay for a lead that semi-targets a consumer with a low or medium-low specificity in terms of profile, place and spending power.

Within your own ATM network, you pay $0 (since you own the channel), and you can place a highly-targeted and actionable offer in front of a consumer who you specifically know (you know who they are, where they are, their economic status, their relationship with your FI, etc.).

Our innovation team is working to harness big data from ATM networks to improve uptime and consumer experiences. By Hormuzd ‘Homi’ Karkaria, VP for software and services solutioning, Diebold

Advertise

Advertise