Taiwan becoming a local hub for RMB settlement and trading

By Nathan Chow Hung Lai (周洪禮)Two days before the Singapore's announcement, financial institutions in Taiwan formally launched their RMB business after signing currency clearing agreements with Bank of China's Taipei branch.

Previously, Taiwan's banks were only allowed to undertake RMB transactions through their offshore banking units. The latest development opens up the RMB business to the domestic banking units, which is ten times bigger than the offshore counterpart.

As yield spread for RMB business is far more attractive than that of TWD, local banks have been aggressively attracting RMB deposits.

In the first week of launching their RMB business, some banks offered up to 1.5% for demand deposits and 3.5% for 3-month time deposits, while others waived the service charges for depositing RMB cash.

We are confident about the initial build-up of RMB liquidity pool in Taiwan due to strong cross-strait economic ties. Over the past decade, bilateral trade between Taiwan and China surged fivefold; growing from USD32 billion in 2001 to more than USD160 billion in 2012. The mainland is now the top trading partner of Taiwan that contributes largely to its trade surplus.

By early-2014, Taiwan's RMB liquidity pool may reach RMB140 billion, about 2% of local deposits.

It comprises of (1) 12% of Taiwan's bilateral trade surplus with the mainland to be settled in RMB (RMB70 billion)1; (2) RMB deposits currently held by Taiwan offshore banking units (RMB21.5 billion); (3) transfer of RMB deposits maintained by Taiwanese entities currently in Hong Kong (est. RMB50 billion).

Due to its heavy reliance on the manufacturing sector, Taiwan and China have established a RMB clearing system.

This will allow Taiwan's manufacturers invoice and settle their mainland trades directly in RMB, rather than swapping from RMB to USD first before final conversion to NTD.

Taiwan's manufacturers will benefit from less exchange rates associated with USD volatility. They will also benefit from lower transaction costs. Also, Taiwanese enterprises operating in China are now able to repatriate their RMB funds back to Taiwan.

Since a significant share of such monetary transfer was made through unofficial channels due to China's tight capital controls, the newly-established clearing mechanism would bring many of the underground activities across the Strait to the surface.

As for the financial sector, the growth of RMB liquidity pool may open up the avenue for RMB-denominated wealth management businesses in Taiwan.

However, unlike Singapore, Taiwan is yet an international financial hub. Such RMB business and products would hence be primarily offered to the local investors.

With respect to the RMB-denominated bond market, some issues need to be addressed first before it can thrive. For instance, a credit rating of BBB or higher is currently required to be listed on the Taiwan's international board.

Meanwhile, Chinese enterprises and financial institutions are prohibited from issuing debt in Taiwan.

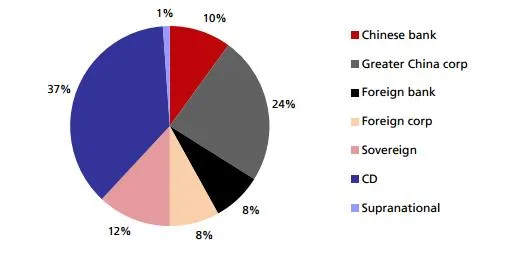

These could be serious hurdles to the market development as Chinese names are the majority of issuers of dim sum bond (Chart 1) and most of them are unrated.

A stalled RMB-denominated bond market will rein in RMB business development in other sectors such as banks, asset funds and insurance companies as they are the traditional bond buyers based on Hong Kong's experience.

_________________________

1 12% of China’s total trade was denominated in RMB in 2012

Advertise

Advertise