In Focus

Which banking roles in Hong Kong earn the highest annually?

Which banking roles in Hong Kong earn the highest annually?

Managing directors in IPO and M&A roles get the highest annual salary.

39 minutes ago

India bank credit hits $2.4t amidst fintech boom

Formal banking reach expanded to 569.3 million Jan Dhan accounts by early November 2025.

1 hour ago

How will Hong Kong banks handle talent shortage and tight budgets?

Investment analysts and compliance specialists remain most sought after.

15 hours ago

Hong Kong banks ‘resilient’ despite falling CRE property values

Many banks have solid earnings and excess capital to absorb potential losses.

23 hours ago

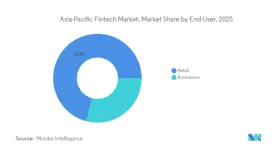

Retail holds 71% of APAC fintech market in 2025

Enterprise users to expand at 25.47% annually through 2031.

1 day ago

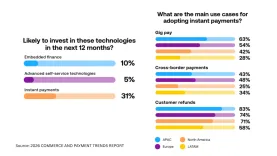

ISO 20022 and agentic AI to drive payment unification in 2026

But financial institutions (FIs) and tech providers must integrate new real-time systems with legacy rails.

4 days ago

4 in 10 APAC firms prefer instant payments for cross border transfers

72% of instant payment use is currently tied to standard customer purchases.

4 days ago

Interoperability vital as 24/7 push hits 'fragmented' Philippine payments

Fragmented ecosystems and limited wallet acceptance will cause abandoned transactions.

5 days ago

Singapore finance firms struggle as 72% face talent gap

Survey shows 94% are revising financial and operational plans to secure workers.

5 days ago

Digital wallets, agentic AI to speed up payments

The focus is on agentic systems that can act on behalf of users.

6 days ago

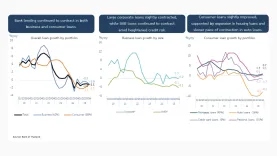

Vietnam banks to weather risks with 16% credit growth target 'reasonable'

Actual loan growth may exceed previous years even as it does not hit the official target.

6 days ago

SME loan 4.1% slump weighs on Thai bank earnings

Overall credit outstanding fell 1.1% year on year across licensed banks and subsidiaries.

6 days ago

Singapore banks lead pay as hiring access ranks low

DBS and OCBC were at the bottom 20% for job opportunities to non-degree holders and less experienced workers.

6 days ago

APAC private banking to grow 9.43% CAGR

The market is forecast to expand from $44.3b in 2025 to $76.05b by 2031.

How will agentic AI change online payments?

It’s unclear who’s liable if it over‑orders or pays the wrong merchant.

Philippine rural banks face merger pressure with tighter capital rules

Many lenders in the countryside have little capital buffer.

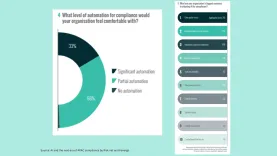

Why Asian banks struggle to embed AI in compliance

Institutions cite fragmented infrastructure, manual workflows and skills gaps as barriers.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision