In Focus

Steady loan outlook erodes as Philippine banks brace for Q1 squeeze

Steady loan outlook erodes as Philippine banks brace for Q1 squeeze

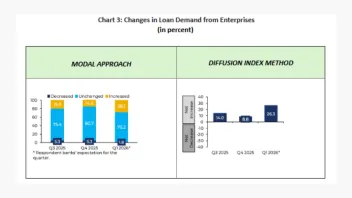

Banks expecting a flat borrowing appetite fell significantly from a previous high of 80.7%.

Vietnam banks face whiplash as fast lending fuels asset price risks

Credit growth target is 15% in 2026, but banks can be hurt if prices correct.

Malaysia credit growth eases to 5.3% as business loans cool

The banking system’s liquidity coverage ratio rose to 154.8% during the month.

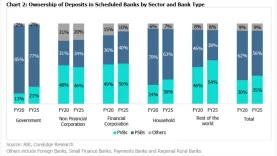

Indian public bank deposit share slumps to 56% as private rivals surge

Household savings held by private lenders climbed from 30% in 2020 to 35% by 2025.

Taiwan bank loan growth to hit high single digits on US pact

Increased overseas investments and corporate credit demand will lift loas.

OCBC and UOB to reverse year-long NIM slide in Q4

DBS Group Research forecasta a quarter-on-quarter margin improvement for two of the big three.

Greater Bay Area loan access index sinks to 48.7 as recovery reverses

Quarterly business confidence data shows lending conditions falling back into contractionary territory.

Banks bet on 2026 growth as India challenges China for capital

China and India are the markets to watch out for.

Banks risk wealth advisor exits without tech upgrades: Cerulli

Just 8% of wealth advisors in the Americas are not yet using wealth tools.

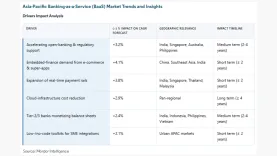

APAC BaaS market to reach $5.3b as embedded finance surges 148%

Regional revenue is set to climb from $4.44b in 2025 to over $12b by 2031.

APAC to capture $4t private credit boom as loan returns shrink

Australia, Japan, and India are emerging as key private credit growth markets.

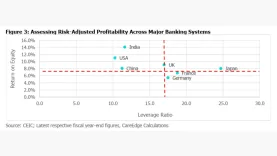

Indian banks outclass Western peers with high-return, low-leverage model

The study groups India where lower gearing aligns with higher performance.

Indian banking returns hit decade-high as global margins shrink

CareEdge report confirms banking metrics are the strongest in years with multi-year low debt ratios.

China bank asset quality risks surge on state lending

Relending rates fell by 25 bps to relieve funding pressure on micro and small enterprises.

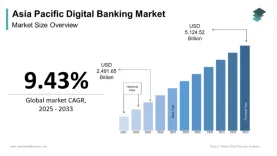

APAC digital banking market to hit $5.12t by 2033

Market Data Forecast projects a 9.43% CAGR through the next decade.

Singapore bank wealth fees surge 44% to defy NIM squeeze

Overall fee income is expected to expand at a double-digit rate of 31% this quarter.

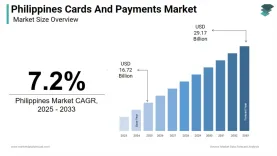

Philippine payments market to hit $29.17b by 2033

The report places 2025 value at $16.72b and tracks a climb from 2024 baseline levels.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership