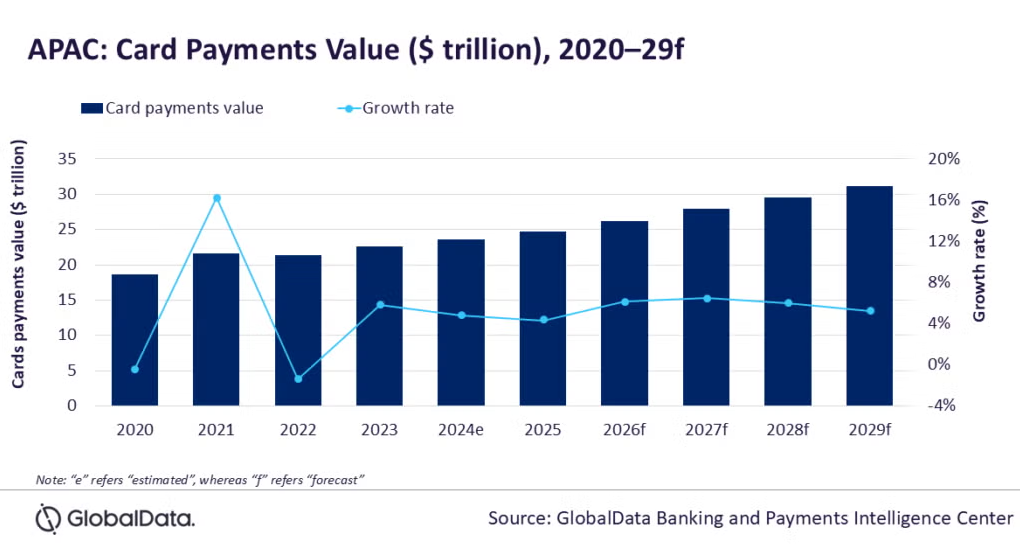

APAC card payments markets to grow 4.3% to $24.7t in 2025

South Asia and SEA countries are skipping cards for mobile wallets, however.

The Asia Pacific (APAC) card payments market is expected to be valued at $24.7t in 2025, a 4.3% growth compared to the previous year.

China, South Korea, Japan, and Australia will register strong growth with their robust card payments market and high card payments value, said GlobalData, a data and analytics company.

“Other markets within the region are also catching up supported by improving payment infrastructure, rising middle-income population, growing financial awareness, and banks offering lucrative benefits in terms of reward programs and instalment facilities,” said Ravi Sharma, lead banking and payments analyst, GlobalData.

Card usage remains low in the Philippines, Indonesia, India, Thailand, and Vietnam. These countries have ‘inadequate’ point-of-sales (POS) infrastructure or have a growing preference for QR-based mobile payments, the report said.

The high cost in POS infrastructure for merchants, and high preference for digital wallets amongst consumers, remain a challenge for pushing faster growth of card payments in APAC.

“Many consumers in the region leapfrogged from cash to digital wallets skipping card payments,” GlobalData said.

Looking ahead, the total card payments market in APAC is expected to continue its upward trajectory, Sharma said.

“However, high preference for mobile payments remains a challenge for their faster adoption. Overall, the card payments value in APAC is expected to register a compound annual growth rate (CAGR) of 6% between 2025 to 2029 to reach $31.1t in 2029,” he added.

Advertise

Advertise