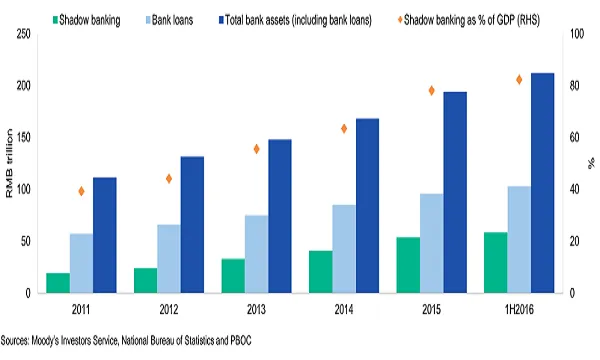

Chart of the Week: China's shadow banking size doubled in the last five years

Borrowers relying on such financing could be at risk of a credit crunch.

Moody's Investors Service estimates that shadow banking assets grew by 9% in the first half of 2016 (equivalent to an 18.6% annualized rate), reaching RMB 58 trillion, equivalent to 82% of GDP. While still rapid, the pace of growth reflects a slowdown from the 30% rate recorded in 2015.

"Given its rapid growth in recent years, shadow banking has become sizeable as a share of bank loans and total bank assets (57% and 27%, respectively, at end-1H2016). The increasing size of the shadow banking system means that during a disorderly contraction, banks could have difficulty replacing shadow banking credit, leaving borrowers who rely on such financing at risk of a credit crunch. It also amplifies spillover risks to the financial system given the degree of interconnectedness," adds Moody's.

Advertise

Advertise