Which Singapore bank is most exposed to the struggling oil and gas sector?

Commodity-related loans could be at risk.

Although Singapore banks' loan books remain relatively sound, Macquarie Securities is on the lookout for weak commodity-related loans.

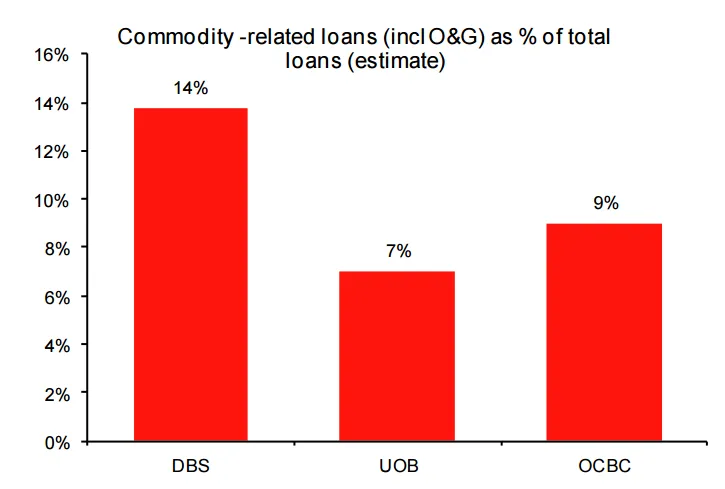

DBS has the largest oil and gas exposure at 14% of total loans, almost double the ratio of commodity-related loans for least-exposed UOB.

Meanwhile oil and gas loans represent 9% of OCBC's total loan books.

“We continue to believe that it is too early to make a negative call on asset quality for Singapore and Malaysia banks at least for the rest of the year. In our base case we expect a normalisation of loan loss provisioning ratios from currently 25 bp to 35 bp over our forecast period,” said the report.

“That said, we turn more guarded on the asset quality outlook for 2016 and beyond. Tail risks have increased materially over the past few months,” Macquarie added.

Advertise

Advertise