Hong Kong’s livi bank unveils new app interface, adds rewards feature

Customers can win cash rewards and enter a lucky draw to win round-trip tickets to Hokkaido.

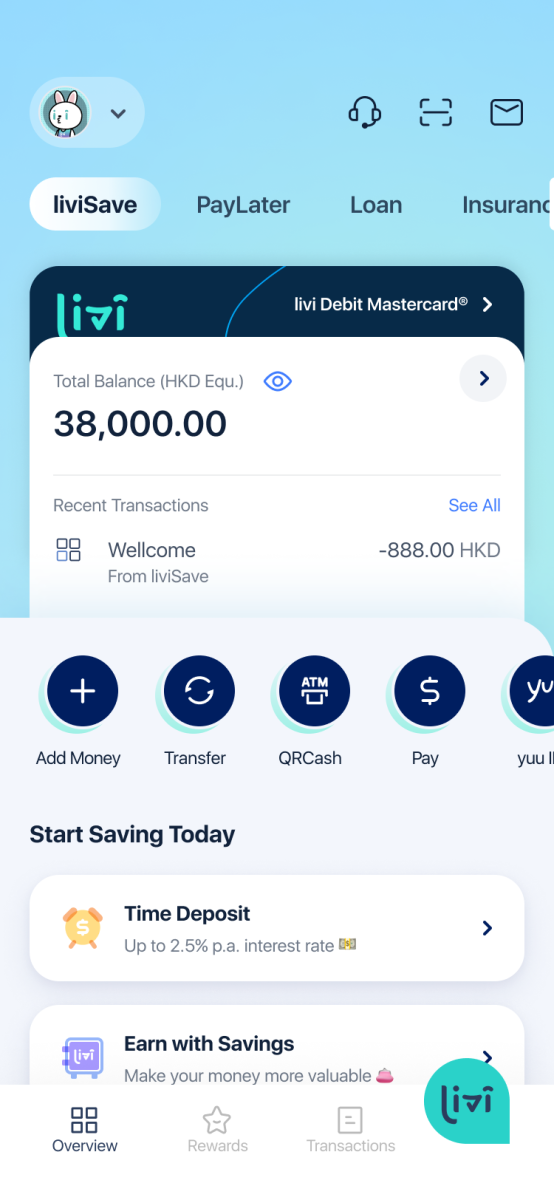

Hong Kong virtual lender livi bank has launched a refreshed app interface and added a rewards feature.

Livi Rewards takes the form of a game centre with personalized monthly missions for customers. Customers can access a variety of rewards that include exclusive offers of cash and extra deposit rate coupons, a limited-edition NFT, or an opportunity to enter into a lucky draw.

Users who complete these missions will have the chance to shake a “Wishing Tree” and get up to 100% cash rewards.

In addition, by completing any mission from now until 31 December 2022, customers can enter a lucky draw with a chance to win limited-time rewards. These include Hokkaido round-trip air tickets and all-inclusive stay in Club Med Hokkaido Resorts for two; a Hong Kong WM Hotel Superior Room stay for two; KKday HK$500 E-Gift Card and more. The lucky draw results will be announced by 31 January 2023.

Advertise

Advertise